Bank of America check deposit smartphone, a revolutionary service, empowers customers to effortlessly deposit checks directly from their mobile devices. This convenient and secure method has transformed the way individuals manage their finances, eliminating the need for physical visits to bank branches.

The service seamlessly integrates with the Bank of America mobile app, enabling users to capture images of checks using their smartphone cameras. This digital transformation has significantly streamlined the check deposit process, offering a faster and more efficient alternative to traditional methods.

Troubleshooting and Support: Bank Of America Check Deposit Smartphone

Mobile check deposit is a convenient way to deposit checks without visiting a branch, but sometimes you may encounter issues. This section will cover common problems you might face during mobile check deposit and how to resolve them.

Common Issues and Solutions

Here are some common issues you might encounter during mobile check deposit and their solutions:

- Check image not clear: Ensure the check is well-lit and placed on a flat surface. Avoid any shadows or glare. If the image is still unclear, try re-taking the photo with better lighting.

- Check is damaged or torn: Do not deposit damaged or torn checks. You can contact Bank of America customer support for guidance on how to proceed.

- Check is not endorsed: Ensure you have endorsed the check properly before taking a picture. The endorsement should be clear and legible.

- Check is for an incorrect amount: Double-check the amount written on the check and ensure it matches the amount you are depositing. If there is an error, you can contact Bank of America customer support for assistance.

- Check is not deposited within the allowed time frame: Each check has a specific time limit for deposit. If the time limit is exceeded, the check may not be accepted. Check the app for details on the time limit.

- App is not working: If you are experiencing problems with the app, try restarting your device and re-opening the app. You can also check if there are any updates available for the app.

Contacting Bank of America Customer Support, Bank of america check deposit smartphone

If you encounter any issues that you cannot resolve yourself, you can contact Bank of America customer support for assistance. You can reach them through the following methods:

- Phone: Call the customer service number provided on the Bank of America website or in your mobile banking app.

- Online: Visit the Bank of America website and use the online chat feature to connect with a customer service representative.

- Branch: Visit a local Bank of America branch for in-person assistance.

Available Resources

In addition to contacting customer support, you can also access the following resources for troubleshooting and support:

- Bank of America website: The website has a comprehensive FAQ section that covers common issues and solutions.

- Mobile banking app: The app has a built-in help section that provides information on how to use the app and troubleshoot common issues.

- Bank of America social media channels: You can reach out to Bank of America through their social media channels like Twitter or Facebook for support and assistance.

Comparison with Other Mobile Deposit Services

Mobile check deposit has become a popular and convenient way for people to deposit checks without visiting a bank branch. Bank of America offers a mobile check deposit service, but it is not the only option available. Let’s explore how Bank of America’s service compares to other popular options, highlighting the advantages and disadvantages of each, and the key factors to consider when choosing a mobile check deposit service.

Comparison of Mobile Check Deposit Services

Choosing the right mobile check deposit service can be a daunting task. There are several services available, each with its own set of features and limitations. Here’s a comparison of some popular options, including Bank of America’s service:

- Bank of America: Bank of America’s mobile check deposit service is available to customers with a checking or savings account. The service allows users to deposit checks up to $5,000 per day, with a maximum deposit limit of $10,000 per month. Deposits are typically available within one business day.

- Chase: Chase’s mobile check deposit service is similar to Bank of America’s, allowing customers to deposit checks up to $5,000 per day and $10,000 per month. The service also offers a feature called “Quick Deposit” which allows users to deposit checks and receive funds within minutes.

- Wells Fargo: Wells Fargo’s mobile check deposit service is also available to customers with a checking or savings account. The service allows users to deposit checks up to $5,000 per day and $10,000 per month. Deposits are typically available within one business day. Wells Fargo’s service also allows users to deposit checks that are payable to another person.

- USAA: USAA offers a mobile check deposit service that is available to its members. The service allows users to deposit checks up to $5,000 per day and $10,000 per month. Deposits are typically available within one business day. USAA’s service also offers a feature called “Express Deposit” which allows users to deposit checks and receive funds within minutes.

- Paypal: Paypal’s mobile check deposit service is available to users with a Paypal account. The service allows users to deposit checks up to $500 per day and $1,000 per month. Deposits are typically available within one business day. Paypal’s service also allows users to deposit checks that are payable to another person.

Key Factors to Consider

When choosing a mobile check deposit service, it’s important to consider the following factors:

- Deposit limits: The amount of money you can deposit per day or per month. Most services have a limit of $5,000 per day and $10,000 per month, but some may have lower or higher limits.

- Availability of funds: How long it takes for the deposited funds to be available in your account. Most services make funds available within one business day, but some may offer faster options.

- Fees: Some services may charge fees for mobile check deposits. It’s important to check the fee schedule before using a service.

- Security: Mobile check deposit services should be secure. Look for services that use encryption and other security measures to protect your personal and financial information.

- Customer support: It’s important to choose a service that offers good customer support in case you have any questions or problems.

Mobile Check Deposit and Business Accounts

Bank of America’s mobile check deposit service is a convenient and efficient way for businesses to manage their finances. It allows you to deposit checks directly from your smartphone, saving you time and effort compared to traditional methods.

Features and Benefits for Business Accounts

The mobile check deposit service offers several features and benefits specifically tailored for business accounts:

- Streamlined Deposit Process: Deposit checks quickly and easily from anywhere with an internet connection. This eliminates the need for physical visits to the bank, saving valuable time and resources.

- Enhanced Security: Bank of America employs advanced security measures to protect your deposits. These measures include encryption technology and multi-factor authentication, ensuring the safety of your business funds.

- Improved Cash Flow Management: Mobile check deposit allows businesses to access funds faster than traditional methods. This improved cash flow can be beneficial for meeting operational expenses and taking advantage of investment opportunities.

- Real-Time Tracking: The service provides real-time tracking of deposited checks, giving you complete visibility into the status of your deposits. This transparency allows for better financial planning and control.

Process for Business Check Deposits

To deposit checks using Bank of America’s mobile check deposit service, businesses need to follow these steps:

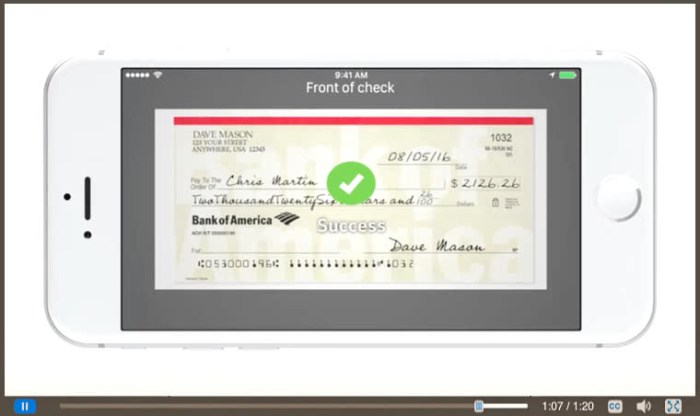

- Log into the Bank of America Mobile App: Access the app on your smartphone and log in using your business account credentials.

- Select “Deposit Check”: Navigate to the check deposit feature within the app.

- Enter Check Information: Provide the necessary information, including the check amount and the payee’s name.

- Capture Check Images: Using your smartphone’s camera, take clear images of both sides of the check, ensuring all details are visible.

- Review and Submit: Carefully review the captured images and the entered information. Once confirmed, submit the deposit request.

Future Trends in Mobile Check Deposit

Mobile check deposit technology is rapidly evolving, driven by advancements in artificial intelligence, image processing, and cybersecurity. This evolution is shaping the future of mobile check deposit, making it more efficient, secure, and user-friendly.

Integration with Other Financial Services

The integration of mobile check deposit with other financial services is a significant trend. This integration will allow users to seamlessly manage their finances, from depositing checks to paying bills and transferring funds, all within a single mobile application. For example, a user could deposit a check, then immediately use the funds to pay a bill or transfer money to another account. This seamless experience will enhance convenience and efficiency for users.

Enhanced Security Measures

Security is paramount in mobile check deposit. The future will see more robust security measures, such as advanced fraud detection algorithms and multi-factor authentication. These measures will protect users from unauthorized access and fraudulent activities. For instance, AI-powered fraud detection systems can analyze transaction patterns and identify suspicious activities, while multi-factor authentication requires users to provide multiple forms of identification, making it harder for unauthorized individuals to access accounts.

Real-time Check Processing

Real-time check processing is another crucial trend. This technology will enable users to access deposited funds almost instantly. Currently, most mobile check deposit services require a few days for funds to be available. Real-time processing will significantly improve the speed and efficiency of transactions, allowing users to access their funds faster.

Biometric Authentication

Biometric authentication is gaining popularity as a secure and convenient way to access accounts. Mobile check deposit services are incorporating biometric authentication methods like facial recognition and fingerprint scanning to enhance security and streamline the deposit process. This technology eliminates the need for users to remember passwords or PINs, making it easier and more secure to access their accounts.

Advanced Image Processing

Advancements in image processing technology will play a crucial role in enhancing the accuracy and efficiency of mobile check deposit. These advancements will enable the system to recognize and process check details, such as the amount and routing number, with greater precision. This will reduce the risk of errors and ensure accurate and timely processing of deposits.

Integration with Wearable Devices

The integration of mobile check deposit with wearable devices like smartwatches is another exciting trend. This integration will allow users to deposit checks directly from their wrists, further enhancing convenience and accessibility. For example, a user could deposit a check while on the go, without having to access their smartphone.

Blockchain Technology

Blockchain technology is poised to revolutionize financial services, including mobile check deposit. Blockchain can provide a secure and transparent platform for processing and tracking transactions, eliminating the need for intermediaries and reducing the risk of fraud.

Artificial Intelligence (AI)

AI will play a pivotal role in enhancing the efficiency and accuracy of mobile check deposit. AI-powered algorithms can analyze check images, extract relevant data, and detect potential fraud. This will streamline the deposit process and improve security.

Impact of Mobile Check Deposit on Banking Industry

Mobile check deposit has revolutionized the banking industry, transforming how customers interact with their finances and impacting traditional banking practices. This technology has fundamentally changed customer behavior and expectations, prompting banks to adapt and innovate to remain competitive.

Impact on Customer Behavior and Expectations

The convenience and speed offered by mobile check deposit have significantly altered customer behavior and expectations. Customers now expect banking services to be readily accessible, efficient, and user-friendly, anytime and anywhere. This has led to an increased demand for digital banking solutions, including mobile apps that provide a seamless and intuitive user experience.

- Increased reliance on digital banking: Mobile check deposit has accelerated the shift towards digital banking, with customers increasingly relying on their smartphones for financial transactions. This trend has been further amplified by the COVID-19 pandemic, as people have become more comfortable managing their finances online.

- Elevated expectations for speed and convenience: Customers have come to expect instant or near-instantaneous transactions, and mobile check deposit has fostered this expectation. The ability to deposit checks from anywhere, at any time, has set a new standard for convenience in banking.

- Greater demand for personalized banking experiences: Mobile check deposit has opened the door for personalized banking experiences, allowing banks to tailor their services to individual customer needs. This includes features like customized alerts, personalized insights, and targeted financial advice.

Long-Term Implications for Traditional Banking Practices

Mobile check deposit has had a profound impact on traditional banking practices, forcing banks to adapt their operations and offerings to meet the evolving needs of customers.

- Branch closures and reduced staffing: As more customers embrace digital banking, banks have begun to reduce their physical footprint, closing branches and streamlining their staffing models. This shift is driven by the lower cost of operating digital services compared to traditional branches.

- Increased competition from non-traditional players: The rise of fintech companies offering innovative digital banking solutions has intensified competition in the banking industry. These companies often focus on providing a seamless and user-friendly mobile experience, challenging traditional banks to keep pace.

- Focus on data analytics and customer insights: To remain competitive, banks are increasingly relying on data analytics to understand customer behavior and preferences. This information is used to develop personalized products and services, improve customer engagement, and enhance risk management.

Impact on Branch Operations

Mobile check deposit has significantly impacted branch operations, reducing the volume of in-person check deposits and leading to changes in branch staffing and services.

- Reduced check deposit volume: With mobile check deposit, customers no longer need to visit branches to deposit checks, resulting in a significant decline in in-person check deposit transactions.

- Shift towards customer service and advisory roles: As the volume of check deposits at branches has decreased, banks have re-allocated staff to focus on customer service, financial advice, and other value-added services.

- Increased reliance on technology: Branches are increasingly relying on technology to provide a more efficient and personalized customer experience. This includes self-service kiosks, digital signage, and other technology-driven solutions.

Impact on Bank Revenue

Mobile check deposit has had a mixed impact on bank revenue, reducing the cost of processing checks but also potentially leading to a decrease in fees associated with traditional check deposits.

- Reduced processing costs: Mobile check deposit has significantly reduced the cost of processing checks for banks, as it eliminates the need for manual handling and physical transportation.

- Potential decrease in check deposit fees: Some banks have reduced or eliminated fees associated with traditional check deposits, as the cost of processing these transactions has decreased.

- Opportunities for new revenue streams: Mobile check deposit has opened up opportunities for banks to generate new revenue streams, such as offering premium mobile banking features or personalized financial advice.

Last Recap

In conclusion, Bank of America’s mobile check deposit service has emerged as a game-changer in the banking industry. Its user-friendly interface, robust security measures, and convenience have made it a popular choice among customers. The service continues to evolve with advancements in mobile technology, further enhancing its efficiency and accessibility. As the world embraces digital banking solutions, Bank of America’s mobile check deposit stands as a testament to the power of innovation in revolutionizing traditional financial practices.

Depositing checks with your Bank of America mobile app is a breeze, but having a reliable smartphone is key. To ensure you’re getting the best value for your money, it’s worth exploring what is the best smartphone plan for your needs.

A plan with ample data and a strong network will guarantee seamless check deposits, allowing you to manage your finances with ease.

Informatif Berita Informatif Terbaru

Informatif Berita Informatif Terbaru