Chase smartphone check deposit revolutionizes the way we bank, offering a convenient and secure way to deposit checks directly from your smartphone. This innovative feature eliminates the need for physical visits to branches, allowing you to manage your finances from anywhere, anytime.

This article will delve into the benefits, process, and technology behind Chase smartphone check deposit, exploring its impact on both users and the banking industry. We’ll examine the security measures in place, analyze user experience, and discuss the future trends shaping this evolving technology.

Mobile Banking Features

Mobile check deposit has revolutionized banking, offering users convenience and speed in depositing checks without visiting a physical branch. This feature allows users to deposit checks directly from their smartphones, saving time and effort.

Benefits of Mobile Check Deposit

Mobile check deposit offers numerous advantages for users.

- Convenience: Users can deposit checks from anywhere with an internet connection, eliminating the need to visit a bank branch.

- Speed: Funds from deposited checks are typically available faster than traditional methods, allowing users to access their money quickly.

- Security: Most banks implement robust security measures to protect user information and prevent fraudulent transactions during mobile check deposit.

- Accessibility: Mobile check deposit provides accessibility to banking services for individuals who may have difficulty traveling to a physical branch.

Features of Mobile Check Deposit

Different banks offer varying features for mobile check deposit.

- Deposit Limits: Some banks impose limits on the amount of money that can be deposited through mobile check deposit per day or month.

- Check Types: Not all banks accept all types of checks for mobile deposit. Some may restrict deposits to personal checks, while others may accept business checks as well.

- Image Capture Quality: The quality of the image captured for the check deposit can affect the processing time. Some banks offer advanced image capture features that ensure clear images, while others rely on basic camera capabilities.

- Real-Time Tracking: Some banks provide real-time tracking of the deposit status, allowing users to monitor the progress of their deposit.

Security Measures for Mobile Check Deposit

Banks prioritize security when implementing mobile check deposit features.

- Multi-Factor Authentication: Most banks require multi-factor authentication, such as a password and a one-time code sent to the user’s phone, to access mobile banking services.

- Encryption: Data transmitted during mobile check deposit is typically encrypted to prevent unauthorized access and protect user information.

- Fraud Detection Systems: Banks utilize sophisticated fraud detection systems to identify and prevent fraudulent transactions, including mobile check deposits.

- Image Verification: Banks often employ image verification technology to ensure that the check being deposited is genuine and not a forgery.

Process of Mobile Check Deposit: Chase Smartphone Check Deposit

Mobile check deposit is a convenient and time-saving feature that allows you to deposit checks directly from your smartphone. This eliminates the need to visit a physical branch or ATM.

Steps Involved in Mobile Check Deposit

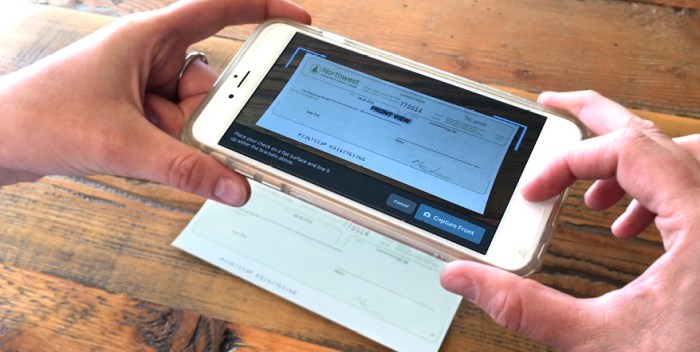

The process of depositing a check using a smartphone app is generally straightforward and can be completed in a few simple steps.

- Open Your Banking App: Begin by opening your bank’s mobile app on your smartphone.

- Select ‘Deposit Check’: Locate the ‘Deposit Check’ or ‘Mobile Deposit’ option within the app. This option is usually found on the main menu or within the ‘Accounts’ section.

- Enter Check Details: You’ll typically need to enter the check amount and the date. Some apps may also require you to select the account you want to deposit the check into.

- Take Photos of the Check: The app will guide you through taking photos of the front and back of the check. Ensure the check is well-lit and that the photos are clear and in focus.

- Review and Submit: Review the check details and photos before submitting the deposit. Once you confirm the information is correct, the deposit will be processed.

Limitations and Restrictions

While mobile check deposit offers a convenient way to deposit checks, there are some limitations and restrictions to be aware of:

- Check Type Restrictions: Most banks restrict mobile check deposits to personal checks. Business checks, cashier’s checks, and government checks may not be eligible for mobile deposit.

- Check Amount Limits: Banks typically set daily or monthly limits on the amount you can deposit using mobile check deposit.

- Check Endorsement: You’ll need to endorse the back of the check before taking photos for mobile deposit. The endorsement should include your signature and the words “For Mobile Deposit Only.”

- Processing Time: While mobile deposits are typically processed quickly, it’s important to note that the funds may not be immediately available for withdrawal. The processing time can vary depending on the bank and the type of check.

- Security Concerns: Ensure you are using a secure Wi-Fi connection or cellular data when depositing checks through your mobile app. Also, be cautious of phishing scams and only deposit checks from trusted sources.

Financial Implications

Mobile check deposit offers a range of financial benefits for both banks and customers, influencing the landscape of traditional banking practices and highlighting the cost-effectiveness of this modern deposit method.

Financial Benefits for Banks

Banks benefit significantly from mobile check deposit by reducing operational costs, attracting new customers, and enhancing customer loyalty.

- Reduced Operational Costs: Mobile check deposit eliminates the need for physical processing of checks, leading to reduced labor costs, paper usage, and associated expenses. This automation streamlines the deposit process, saving banks significant resources.

- Increased Customer Acquisition: Offering mobile check deposit as a convenient service attracts new customers who value digital banking solutions. This competitive advantage helps banks expand their customer base and increase market share.

- Enhanced Customer Loyalty: The convenience and accessibility of mobile check deposit foster customer satisfaction and loyalty. Customers appreciate the ability to deposit checks anytime, anywhere, leading to stronger relationships with their bank.

Financial Benefits for Customers

Mobile check deposit empowers customers with greater control over their finances, saving time and money, and enhancing security.

- Time Savings: Mobile check deposit eliminates the need for physical visits to the bank or ATMs, saving customers valuable time. Customers can deposit checks from their homes, offices, or anywhere with an internet connection.

- Cost Savings: Mobile check deposit eliminates the costs associated with traditional check deposits, such as postage, gas, and parking fees. This cost-effective method saves customers money and improves their financial well-being.

- Enhanced Security: Mobile check deposit often involves multi-factor authentication and encryption, providing a secure environment for depositing checks. This security measure protects customers from fraud and unauthorized access to their accounts.

Impact on Traditional Banking Practices

Mobile check deposit is significantly impacting traditional banking practices, leading to a shift towards digital banking solutions and increased competition.

- Decline in Branch Visits: The convenience of mobile check deposit reduces the need for customers to visit bank branches for deposits, leading to a decline in branch traffic. This shift towards digital banking requires banks to adapt their operations and invest in technology.

- Increased Competition: The widespread adoption of mobile check deposit by banks has intensified competition within the financial industry. Banks are constantly striving to offer innovative digital banking solutions to attract and retain customers in this evolving landscape.

Cost-Effectiveness of Mobile Check Deposit

Mobile check deposit is a highly cost-effective method compared to traditional check deposit methods, saving both banks and customers significant resources.

- Reduced Processing Costs: For banks, mobile check deposit eliminates the labor costs associated with manual check processing, reducing overhead expenses. This automation streamlines the deposit process, making it more efficient and cost-effective.

- Elimination of Physical Costs: For customers, mobile check deposit eliminates the costs associated with traditional check deposits, such as postage, gas, and parking fees. This cost-effective method saves customers money and improves their financial well-being.

Security Concerns

While mobile check deposit offers convenience, it’s crucial to understand the potential security risks associated with this technology. This section explores these risks and provides practical tips to safeguard your financial information and minimize the chances of fraud.

Security Risks Associated with Mobile Check Deposit, Chase smartphone check deposit

Mobile check deposit involves transmitting sensitive financial data through mobile devices, making it susceptible to various security threats. Some common risks include:

- Unauthorized Access: If your mobile device is lost or stolen, unauthorized individuals could gain access to your banking information and potentially deposit fraudulent checks. This risk is heightened if you haven’t enabled strong security measures like a PIN or biometric authentication.

- Malware and Phishing Attacks: Malicious software (malware) can be installed on your device through phishing emails or suspicious links, enabling attackers to steal your banking credentials or intercept your check deposit transactions. These attacks often exploit vulnerabilities in outdated software, emphasizing the importance of regular updates.

- Data Breaches: While banks strive to protect user data, data breaches at financial institutions or mobile service providers can compromise your personal and financial information, potentially leading to fraudulent check deposits.

- Check Forgery: Mobile check deposit technology relies on image capture and verification. However, sophisticated forgers can manipulate images to alter check details, leading to unauthorized deposits.

Best Practices for Protecting User Data and Preventing Fraud

To mitigate these risks, banks and users should implement robust security measures:

- Strong Passwords and Multi-Factor Authentication: Utilize strong, unique passwords for your mobile banking app and enable multi-factor authentication (MFA) to add an extra layer of security. MFA typically involves receiving a one-time code via SMS or email, which must be entered along with your password to access your account.

- Regular Software Updates: Ensure your mobile device’s operating system and banking app are updated regularly to patch security vulnerabilities and prevent malware infections. This proactive approach significantly reduces the risk of exploitation by attackers.

- Secure Mobile Device: Use a strong passcode or biometric authentication (fingerprint or facial recognition) to lock your device and prevent unauthorized access. Consider installing reputable antivirus software to detect and remove malware.

- Check Deposit Limits: Banks often impose daily or monthly limits on mobile check deposits to minimize potential losses from fraudulent activity. Adhering to these limits helps protect both you and the bank.

- Verify Check Details: Before depositing a check, carefully verify all details, including the payee’s name, amount, and account number, to ensure accuracy and prevent potential errors or fraud.

- Report Suspicious Activity: Immediately report any suspicious activity, such as unauthorized transactions or unauthorized access attempts, to your bank. Prompt action can help prevent further damage.

Comparison of Security Measures Implemented by Different Banks

Banks are constantly evolving their security measures to combat evolving threats. Here’s a comparison of some common security features:

| Bank | Security Features |

|---|---|

| Bank A | Multi-factor authentication, device security, fraud monitoring, encryption, daily deposit limits. |

| Bank B | Biometric authentication, real-time fraud detection, data encryption, check image verification, secure messaging. |

| Bank C | Two-factor authentication, device lock, secure storage of check images, fraud alert system, transaction monitoring. |

“While banks are implementing advanced security measures, it’s crucial for users to be vigilant and follow best practices to protect their financial information.”

Case Studies

Mobile check deposit has become a standard feature for many banks, offering customers convenience and efficiency. By examining successful implementations and promotion strategies, we can gain valuable insights into the effectiveness of this service.

Successful Implementations

Several banks have successfully implemented mobile check deposit services, demonstrating the positive impact on customer satisfaction and financial performance.

- Bank of America: Bank of America’s mobile check deposit service, launched in 2010, has become one of the most widely used mobile banking features. The bank has seen a significant increase in mobile check deposit adoption, with millions of customers using the service every month. This success can be attributed to factors such as user-friendly interface, robust security measures, and effective marketing campaigns.

- Chase: Chase Bank has also experienced remarkable success with its mobile check deposit service. The bank has consistently ranked high in customer satisfaction surveys for its mobile banking offerings, including check deposit. Chase’s strategy involves a combination of features like real-time deposit confirmation, fraud detection, and customer support, which have contributed to high adoption rates.

- Wells Fargo: Wells Fargo’s mobile check deposit service has been instrumental in increasing customer engagement and driving revenue. The bank’s focus on security, convenience, and user experience has resulted in high customer satisfaction and increased adoption rates. Wells Fargo has also leveraged its extensive branch network to promote mobile check deposit, providing customers with in-person support and guidance.

Promotion Strategies

Banks have employed various strategies to promote and enhance their mobile check deposit services.

- Marketing Campaigns: Banks have used targeted marketing campaigns to educate customers about the benefits of mobile check deposit. These campaigns have included email marketing, social media advertising, and mobile app notifications.

- Incentives: Some banks have offered incentives to encourage customers to use mobile check deposit, such as cash back rewards or bonus points.

- Partnerships: Banks have partnered with other businesses to promote mobile check deposit. For example, banks have partnered with retailers to offer mobile check deposit options at point-of-sale terminals.

- User Experience: Banks have focused on improving the user experience of their mobile check deposit services. This includes features like clear instructions, intuitive design, and real-time deposit confirmation.

Adoption Rates Across Demographics

Mobile check deposit adoption rates vary across different demographics.

- Age: Younger generations, such as millennials and Gen Z, are more likely to adopt mobile check deposit than older generations. This is due to their familiarity with technology and preference for digital banking solutions.

- Income: Higher-income earners are more likely to use mobile check deposit, as they tend to have more financial transactions and are more tech-savvy.

- Location: Urban areas with high mobile phone penetration rates tend to have higher mobile check deposit adoption rates.

Regulation and Compliance

Mobile check deposit, a convenient feature for banking customers, is subject to a robust regulatory framework that ensures security, fairness, and compliance. This section explores the key regulations governing mobile check deposit and how banks must comply to offer this service.

Regulatory Framework for Mobile Check Deposit

The regulatory landscape for mobile check deposit is complex and involves multiple agencies. Key regulations include:

- The Electronic Fund Transfer Act (EFTA): This federal law governs electronic fund transfers, including mobile check deposits. It establishes consumer protections, such as limits on liability for unauthorized transfers and requirements for clear disclosures about fees and terms.

- Regulation E: This regulation, issued by the Federal Reserve Board, implements the EFTA. It Artikels specific rules for electronic fund transfers, including requirements for error resolution, disclosure of terms, and consumer rights.

- The Uniform Commercial Code (UCC): This set of laws governs commercial transactions, including negotiable instruments like checks. The UCC provides a framework for check deposit, including rules for endorsements, presentment, and payment.

- State Laws: Many states have their own laws that apply to check deposit, including mobile check deposit. These laws may address issues such as consumer protection, check fraud, and electronic signatures.

Compliance Requirements for Banks

Banks offering mobile check deposit services must adhere to a range of compliance requirements. These include:

- Risk Management: Banks must have robust risk management programs in place to mitigate the risks associated with mobile check deposit, such as fraud and unauthorized transactions.

- Customer Due Diligence (CDD): Banks must verify the identity of their customers and conduct due diligence to prevent money laundering and other financial crimes.

- Security Measures: Banks must implement strong security measures to protect customer data and prevent unauthorized access to their mobile banking platforms.

- Data Privacy: Banks must comply with data privacy regulations, such as the General Data Protection Regulation (GDPR) in Europe, and protect customer data from unauthorized disclosure or misuse.

- Anti-Money Laundering (AML) and Know Your Customer (KYC) Compliance: Banks must comply with AML and KYC regulations, which require them to identify and verify the identities of their customers and monitor transactions for suspicious activity.

- Internal Controls: Banks must have strong internal controls in place to ensure that mobile check deposit transactions are processed accurately and securely.

- Recordkeeping: Banks must maintain accurate records of all mobile check deposit transactions, including the check image, deposit amount, and date of deposit.

Impact of Regulatory Changes

Regulatory changes can significantly impact mobile check deposit practices. For example, the introduction of new data privacy regulations, such as the GDPR, has led banks to implement more stringent data protection measures and update their privacy policies. Similarly, changes to AML and KYC regulations may require banks to enhance their customer verification processes and transaction monitoring systems. Banks must stay abreast of evolving regulations and adapt their mobile check deposit practices accordingly to ensure ongoing compliance.

Impact on Business Operations

Mobile check deposit has significantly impacted business operations, transforming the way businesses receive and process payments. This technology streamlines payment procedures, reduces administrative overhead, and enhances overall efficiency.

Benefits of Implementing Mobile Check Deposit

Mobile check deposit offers numerous benefits for businesses, including:

- Enhanced Efficiency: Businesses can process checks more quickly and efficiently, reducing manual labor and processing time. Mobile check deposit eliminates the need for physical trips to the bank, allowing businesses to deposit checks from anywhere with an internet connection.

- Reduced Costs: By automating the check deposit process, businesses can minimize administrative expenses associated with traditional check deposits, such as postage, bank fees, and staff time.

- Improved Cash Flow: Faster check processing translates into quicker access to funds, improving cash flow and enabling businesses to make timely payments and investments.

- Increased Customer Satisfaction: Mobile check deposit offers customers greater convenience and flexibility, allowing them to deposit checks at their convenience, which can enhance customer satisfaction and loyalty.

Challenges of Implementing Mobile Check Deposit

While mobile check deposit offers substantial advantages, businesses should consider potential challenges:

- Security Concerns: Ensuring the security of sensitive financial information during mobile check deposits is paramount. Businesses must implement robust security measures to prevent fraud and unauthorized access.

- Technical Integration: Integrating mobile check deposit into existing business systems and processes can require technical expertise and resources. Businesses need to ensure compatibility with their current accounting and banking software.

- Compliance Requirements: Mobile check deposit is subject to regulations and compliance requirements, which businesses must adhere to. Understanding and meeting these requirements is crucial for legal and financial security.

Examples of Successful Integration

Several businesses have successfully integrated mobile check deposit into their operations, reaping significant benefits:

- Retail Businesses: Retailers can expedite the processing of customer checks, improving customer service and reducing wait times at checkout. Mobile check deposit allows customers to deposit checks directly at the point of sale, streamlining the payment process.

- Service Businesses: Service businesses, such as home healthcare providers or cleaning services, can receive payments from clients quickly and securely through mobile check deposit. This eliminates the need for physical check delivery and ensures prompt payment collection.

- Real Estate Companies: Real estate companies can facilitate faster and more convenient rent payments from tenants using mobile check deposit. This reduces administrative overhead and improves cash flow for property management.

Consumer Behavior

Mobile check deposit has significantly altered consumer behavior regarding banking and financial transactions, creating a more convenient and accessible banking experience.

Impact of Mobile Check Deposit on Consumer Behavior

Mobile check deposit has led to a shift in consumer behavior towards digital banking solutions, driving a decline in physical branch visits and traditional check deposit methods. This shift is primarily attributed to the convenience and accessibility offered by mobile check deposit.

Factors Influencing Consumer Preference for Mobile Check Deposit

- Convenience: Mobile check deposit eliminates the need to physically visit a bank branch, saving time and effort. Consumers can deposit checks anytime, anywhere, using their smartphones.

- Accessibility: Mobile check deposit allows consumers to deposit checks even when they are away from home or their bank branch. This accessibility is particularly beneficial for individuals who travel frequently or have busy schedules.

- Speed: Funds from mobile check deposits are typically available faster than traditional check deposits, providing consumers with quicker access to their money.

- Security: Mobile banking applications employ robust security measures, such as encryption and multi-factor authentication, to protect user data and financial transactions.

Potential for Mobile Check Deposit to Change Consumer Financial Habits

Mobile check deposit has the potential to significantly change consumer financial habits, encouraging more frequent and convenient financial transactions. This could lead to:

- Increased use of mobile banking: Mobile check deposit is likely to drive greater adoption of mobile banking services, leading to a more digitally-driven financial ecosystem.

- Reduced reliance on cash: As consumers become more comfortable with mobile check deposit, they may opt for cashless transactions, further accelerating the trend towards a cashless society.

- Improved financial literacy: Mobile banking apps often provide users with insights into their spending habits and financial status, potentially improving financial literacy and promoting responsible financial management.

Epilogue

Chase smartphone check deposit represents a significant leap forward in banking convenience, empowering users with greater control over their finances. By seamlessly integrating technology with traditional banking practices, this feature streamlines the deposit process, enhances security, and offers a user-friendly experience. As technology continues to evolve, we can expect even more innovative and efficient solutions to emerge, further transforming the way we manage our money.

Chase’s smartphone check deposit feature is a convenient way to deposit checks without visiting a branch. This feature is particularly helpful for teenagers who often use their smartphones for everything from communication to banking. Teenagers with smartphones are increasingly embracing digital banking solutions, and Chase’s mobile app makes it easy for them to manage their finances on the go.

By utilizing the app, teenagers can deposit checks quickly and securely, fostering financial responsibility and independence.

Informatif Berita Informatif Terbaru

Informatif Berita Informatif Terbaru