Bank of America smartphone deposit takes center stage, offering a convenient and secure way to deposit checks directly from your mobile device. This feature eliminates the need for physical visits to a branch, saving you time and effort. With just a few taps on your smartphone, you can deposit checks quickly and easily, making banking a breeze.

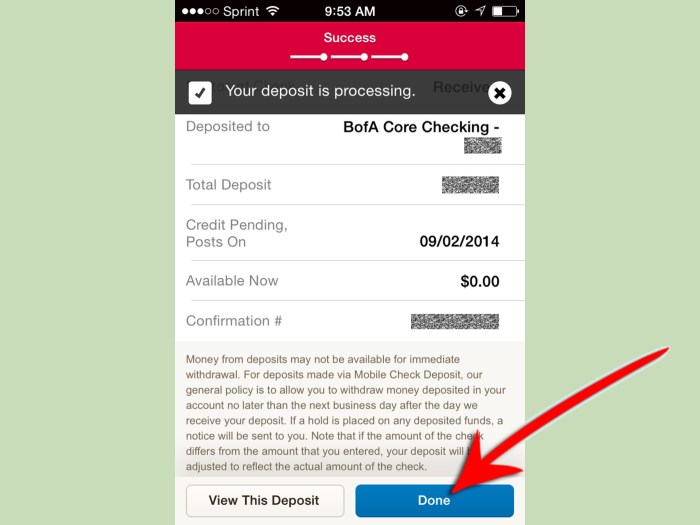

The process is straightforward and user-friendly, guided by the Bank of America mobile app. Simply snap a picture of the check, endorse it, and submit it for deposit. The app utilizes advanced image recognition technology to verify the check’s authenticity and ensure secure transactions. Bank of America’s mobile deposit feature offers a range of benefits, including enhanced convenience, time-saving capabilities, and increased security.

Security Measures for Mobile Deposits: Bank Of America Smartphone Deposit

Bank of America takes security seriously when it comes to mobile deposits. The app utilizes various measures to ensure the safety of your funds and personal information.

Authenticity Verification of Checks

The Bank of America mobile app employs advanced technology to verify the authenticity of checks before processing them. The app utilizes a combination of image analysis and fraud detection algorithms to scrutinize the check’s details, including the signature, routing number, and account number. This process helps prevent fraudulent transactions and protects you from potential losses.

Mobile Deposit Limits and Fees

Bank of America has established daily and monthly limits for mobile deposits. These limits are designed to help protect you from fraud and ensure the security of your account. Additionally, there are fees associated with certain mobile deposit transactions.

Daily and Monthly Limits

Mobile deposit limits are based on your individual account type and banking history. You can find your specific limits by logging into your Bank of America mobile banking app.

- Daily Limit: The daily limit for mobile deposits is typically between $1,000 and $5,000, depending on your account type and history.

- Monthly Limit: The monthly limit for mobile deposits is typically between $5,000 and $10,000, depending on your account type and history.

Fees Associated with Mobile Deposits

Generally, there are no fees associated with using Bank of America’s mobile deposit feature. However, there may be fees for certain types of transactions, such as:

- Deposits exceeding the daily or monthly limits: You may be charged a fee for deposits that exceed your limits. The fee amount will vary depending on your account type and the amount of the deposit.

- Deposits made with a third-party app: If you use a third-party app to make a mobile deposit, Bank of America may charge a fee. This fee will vary depending on the third-party app and the type of deposit.

Increasing Deposit Limits

If you need to increase your mobile deposit limits, you can contact Bank of America customer service. They can review your account and may be able to increase your limits based on your banking history and account activity.

Comparison to Other Mobile Deposit Services

Mobile deposit is a convenient feature offered by many banks and financial institutions. Bank of America’s mobile deposit service is just one of many options available. Comparing Bank of America’s mobile deposit service to other mobile deposit services offered by competing banks can help you determine which service best meets your needs.

Key Features and Differences

Mobile deposit services offered by different banks typically share similar core features, such as the ability to deposit checks using your smartphone or tablet. However, there are some key differences to consider, such as deposit limits, processing times, fees, and available features.

Deposit Limits

The maximum amount you can deposit per check or per day can vary between banks. Some banks may have higher deposit limits for certain account types or for customers with a specific account history.

Processing Times

The time it takes for a mobile deposit to be credited to your account can also vary. Some banks may offer faster processing times, while others may take longer. Factors that can influence processing time include the bank’s internal processes, the time of day the deposit is made, and the type of check being deposited.

Fees

Some banks may charge fees for using their mobile deposit service, while others offer it for free. Fees may be based on the number of deposits made, the amount deposited, or other factors.

Additional Features

Some mobile deposit services offer additional features, such as the ability to track the status of your deposits, view images of deposited checks, and receive notifications when a deposit is processed.

Factors to Consider

When choosing a mobile deposit service, there are several factors to consider:

- Deposit limits: Make sure the deposit limits are sufficient for your needs.

- Processing times: Consider how quickly you need funds to be available in your account.

- Fees: Be aware of any fees associated with using the service.

- Additional features: Determine which features are important to you.

- Security: Choose a bank with a strong reputation for security and data protection.

Mobile Deposit and Account Security

Mobile deposit offers convenience, but it’s crucial to be aware of potential security risks and implement protective measures. By understanding these risks and following best practices, you can significantly reduce the likelihood of fraud or unauthorized access to your account.

Security Risks Associated with Mobile Deposits

Mobile deposits, while convenient, are not without their security risks. It’s important to understand these risks to implement appropriate safeguards.

- Malware and Phishing Attacks: Malicious software can steal your login credentials, account information, or even capture images of your checks during the deposit process. Phishing scams can trick you into revealing sensitive data through fake websites or emails.

- Unsecured Wi-Fi Networks: Using public or unsecured Wi-Fi networks for mobile deposits can expose your transaction data to potential eavesdroppers.

- Lost or Stolen Devices: If your smartphone is lost or stolen, it could compromise your account if it’s not properly secured with a passcode or biometric authentication.

- Data Breaches: While rare, data breaches at financial institutions or mobile service providers can expose your account information, including deposit details.

Safeguarding Account Information During Mobile Deposits

To mitigate these risks, it’s essential to adopt robust security practices.

- Use Strong Passwords: Employ a unique and complex password for your banking app, including a combination of uppercase and lowercase letters, numbers, and symbols.

- Enable Two-Factor Authentication (2FA): 2FA adds an extra layer of security by requiring a code sent to your phone or email in addition to your password.

- Secure Your Device: Protect your smartphone with a strong passcode, fingerprint, or facial recognition, and keep your operating system and apps updated with the latest security patches.

- Avoid Public Wi-Fi for Deposits: Use a secure, private Wi-Fi network or cellular data for mobile deposits.

- Report Suspicious Activity: Immediately report any suspicious activity or unauthorized transactions to your bank.

- Monitor Your Account Regularly: Regularly review your account statements and transaction history for any unusual or unauthorized activity.

Proactive measures can further minimize the risk of fraud and unauthorized access.

- Verify the Bank’s App: Download the official banking app from reputable app stores like Google Play or Apple App Store.

- Check for Security Indicators: Look for a padlock icon in the address bar of your browser when accessing your bank’s website or app. This indicates a secure connection.

- Avoid Public Wi-Fi for Deposits: Using a secure, private Wi-Fi network or cellular data for mobile deposits can help prevent eavesdropping on your transaction data.

- Use a Virtual Private Network (VPN): When using public Wi-Fi, a VPN can encrypt your internet traffic, making it more difficult for hackers to intercept your data.

- Report Suspicious Activity: If you suspect any suspicious activity, contact your bank immediately to report it.

- Regularly Review Your Account: Regularly check your account statements and transaction history for any unauthorized activity.

Mobile Deposit and Customer Experience

Bank of America’s mobile deposit feature aims to simplify the process of depositing checks, offering convenience and accessibility to its customers. The feature allows users to deposit checks directly from their smartphones, eliminating the need for physical visits to bank branches.

Customer Reviews and Feedback, Bank of america smartphone deposit

Customer reviews and feedback provide valuable insights into the user experience of Bank of America’s mobile deposit feature. Many users praise the feature for its ease of use, convenience, and speed. They appreciate the ability to deposit checks from anywhere, anytime, without having to visit a branch.

“I love using Bank of America’s mobile deposit feature. It’s so easy to use and saves me a lot of time. I can deposit checks from my phone in just a few minutes, without having to go to the bank.” – John, a Bank of America customer

However, some users have reported occasional issues with the feature, such as difficulties with image clarity or slow processing times.

Convenience and Ease of Use

Bank of America’s mobile deposit feature is designed to be user-friendly and convenient. The process typically involves taking a photo of the front and back of the check using the mobile app, entering the amount, and confirming the deposit. The app provides clear instructions and guidance throughout the process, making it easy for users to navigate.

“I’ve been using Bank of America’s mobile deposit for a while now, and it’s been a game-changer. It’s so easy to use, and I’ve never had any problems with it. I highly recommend it.” – Sarah, a Bank of America customer

The feature’s convenience is further enhanced by its availability 24/7, allowing users to deposit checks whenever it is convenient for them.

Mobile Deposit and Financial Literacy

Mobile deposit can play a significant role in improving financial literacy by making it easier for individuals to track their finances and make informed decisions about their money.

Mobile Deposit Encourages Responsible Budgeting

The convenience of mobile deposit can help users develop better budgeting habits. By making it simple to deposit checks and monitor account balances, mobile deposit allows individuals to track their income and expenses in real-time. This real-time visibility fosters a greater awareness of spending patterns and helps individuals identify areas where they can cut back or allocate funds more effectively.

Resources and Tips for Enhancing Financial Knowledge

- Budgeting Apps: Numerous budgeting apps are available, offering features like expense tracking, goal setting, and personalized financial advice. These apps can help individuals gain insights into their spending habits and make informed decisions about their money.

- Financial Literacy Websites: Websites like the Consumer Financial Protection Bureau (CFPB) and the National Endowment for Financial Education (NEFE) provide valuable resources on topics such as budgeting, saving, investing, and credit management.

- Financial Education Courses: Many community colleges, universities, and online platforms offer financial literacy courses that cover a wide range of topics. These courses can provide individuals with a deeper understanding of personal finance principles and strategies.

Mobile Deposit and Accessibility

Bank of America’s mobile deposit feature aims to provide a convenient and accessible banking experience for all users, including those with disabilities. The platform incorporates various features and functionalities designed to enhance accessibility and inclusivity.

Accessibility Features and Functionalities

Bank of America’s mobile deposit feature includes several features and functionalities that support accessibility for users with disabilities. These include:

- Screen Reader Compatibility: The mobile deposit feature is compatible with screen readers, allowing visually impaired users to navigate the app and complete transactions independently. Screen readers provide audible feedback on the content displayed on the screen, enabling users to understand the information and interact with the app.

- High-Contrast Mode: The app offers a high-contrast mode option, which increases the contrast between text and background colors. This feature is beneficial for users with low vision or color blindness, improving readability and visual clarity.

- Text Size Adjustment: Users can adjust the text size within the app to suit their visual preferences and needs. This flexibility ensures that the text is legible for individuals with visual impairments or those who prefer larger text sizes.

- Voice Control: Some mobile devices offer voice control capabilities that can be integrated with the Bank of America app. Users can use voice commands to navigate the app, deposit checks, and perform other banking tasks, providing an alternative input method for individuals with mobility limitations.

Potential Barriers and Solutions

Despite the efforts to enhance accessibility, some potential barriers or challenges might hinder users with disabilities from fully utilizing the mobile deposit feature.

- Complex Navigation: While the app incorporates accessibility features, the navigation structure might still pose challenges for some users, particularly those with cognitive disabilities. Simplifying the navigation structure and providing clear instructions can enhance accessibility for this user group.

- Image-Based Check Processing: The mobile deposit feature relies on capturing images of checks for processing. This process can be challenging for users with visual impairments who may struggle to accurately align the check within the designated area or identify the correct information on the check.

- Lack of Braille Support: While the app is compatible with screen readers, it currently lacks direct support for Braille input or output. Integrating Braille support would significantly improve accessibility for users who rely on Braille for communication and navigation.

To address these potential barriers, Bank of America could implement the following solutions:

- Simplified Navigation and User Interface: Streamlining the navigation structure, providing clear and concise instructions, and employing intuitive icons can enhance the accessibility of the app for users with cognitive disabilities.

- Alternative Check Processing Methods: Exploring alternative check processing methods, such as allowing users to manually enter check information or using OCR technology to automatically extract data from check images, can benefit users with visual impairments.

- Braille Support: Integrating Braille support into the app would provide a valuable accessibility feature for users who rely on Braille. This could include a Braille display for output or a Braille keyboard for input.

Conclusive Thoughts

Bank of America’s smartphone deposit feature is a testament to the evolving landscape of mobile banking. It empowers users with a convenient and secure way to manage their finances, offering a seamless experience that is both time-efficient and user-friendly. As technology continues to advance, we can expect even more innovative mobile banking solutions to emerge, further simplifying financial transactions and enhancing the overall banking experience.

Bank of America’s smartphone deposit feature allows you to conveniently deposit checks from anywhere, anytime. This feature is especially useful for those who are always on the go and appreciate a seamless banking experience. A key factor in making this process user-friendly is having a user friendly smartphone with a clear camera and a responsive touch screen.

With a reliable smartphone, depositing checks with Bank of America becomes a simple and efficient process.

Informatif Berita Informatif Terbaru

Informatif Berita Informatif Terbaru