Smartphone payment plans have become increasingly popular, offering consumers a flexible way to acquire the latest devices. From carrier contracts to financing options, these plans cater to a range of budgets and preferences. Understanding the intricacies of smartphone payment plans is crucial for making informed decisions and maximizing value.

This guide explores the various aspects of smartphone payment plans, providing a comprehensive overview of their benefits, costs, and potential pitfalls. We delve into the different types of plans available, analyze the impact of interest rates and fees, and offer tips for choosing the right plan for your individual needs.

Smartphone Payment Plans

A smartphone payment plan is a financing option that allows you to purchase a smartphone over a set period of time, typically 12 to 36 months, with regular monthly payments. Instead of paying the full price upfront, you make smaller, more manageable payments. These plans can be offered by carriers, retailers, or independent lenders.

Benefits of Smartphone Payment Plans

Smartphone payment plans offer several benefits for consumers, including:

- Affordability: By breaking down the cost of a smartphone into smaller monthly payments, payment plans make high-end devices more accessible to a wider range of consumers.

- Upgradability: Many payment plans allow you to upgrade to a newer model after a certain period, typically 12 to 24 months, without having to pay the full price upfront. This allows you to stay up-to-date with the latest technology without significant financial strain.

- Convenience: Payment plans can be integrated into your monthly bills, making it easier to manage your finances and avoid large upfront expenses.

Types of Smartphone Payment Plans

There are various types of smartphone payment plans available, each with its own terms and conditions. Here are some common examples:

- Carrier Contracts: Carriers often offer subsidized smartphones with a contract that locks you in for a certain period, typically 24 months. You pay a lower upfront price for the device but agree to pay a higher monthly fee for service. The subsidized price of the phone is often offset by the higher monthly fees.

- Lease Agreements: A lease agreement allows you to rent a smartphone for a fixed period, typically 12 to 24 months. At the end of the lease term, you can return the device, upgrade to a newer model, or purchase the phone outright. This option can be beneficial if you want to try out a new phone without committing to a long-term contract.

- Financing Options: Retailers and independent lenders offer financing options that allow you to purchase a smartphone with a loan. These options typically come with interest rates and may require a credit check. You make regular monthly payments until the loan is paid off. This can be a good option if you prefer to own the device outright and don’t want to be tied to a carrier contract.

Cost Comparison

When deciding whether to buy a smartphone outright or use a payment plan, it’s crucial to weigh the financial implications. Both options have their advantages and disadvantages, and understanding the total cost involved can help you make an informed decision.

Purchasing a smartphone outright generally results in a higher upfront cost but eliminates the added expenses associated with payment plans, such as interest charges and activation fees. Payment plans, on the other hand, allow you to spread the cost over time, making the device more accessible. However, it’s essential to consider the long-term financial impact of interest rates and fees, which can significantly increase the overall cost of the smartphone.

Comparing Total Costs

The total cost of a smartphone depends on the chosen purchase method. Let’s compare the two scenarios:

- Outright Purchase: The total cost is the price of the smartphone. For example, if a smartphone costs $1,000, you’ll pay $1,000 upfront.

- Payment Plan: The total cost includes the price of the smartphone, interest charges, and any applicable fees. For example, a $1,000 smartphone on a 24-month payment plan with a 10% interest rate could result in a total cost of $1,240. This is because you’ll pay $50 per month for 24 months, totaling $1,200, plus an additional $40 in interest charges.

Impact of Interest Rates and Fees

Interest rates and fees significantly impact the overall cost of a payment plan. Higher interest rates and fees mean higher total costs. For example, a 15% interest rate on a $1,000 smartphone could result in a total cost of $1,300, compared to $1,240 with a 10% interest rate. It’s essential to research and compare different payment plan options to find the most affordable one with the lowest interest rates and fees.

Smartphone payment plans can be a convenient way to get a new device, but they can also lock you into long contracts. If you prefer flexibility, a pay-as-you-go phone might be a better option. You can find a great selection of pay-as-you-go phones on sites like best pay as u go smartphone.

This way, you only pay for the data and minutes you use, and you’re not tied down to a monthly plan.

Finding Affordable Payment Plan Options

Here are some tips for finding affordable smartphone payment plan options:

- Compare interest rates and fees: Shop around and compare offers from different carriers and retailers. Look for plans with low interest rates and minimal fees.

- Consider trade-in options: Many carriers and retailers offer trade-in programs where you can get credit towards a new smartphone by trading in your old device.

- Look for promotions and discounts: Keep an eye out for special promotions and discounts, such as bundled deals or financing offers.

- Explore prepaid options: Prepaid plans can be a more affordable alternative to traditional payment plans, as they often don’t involve interest charges.

Contract vs. Lease vs. Financing

When choosing a smartphone payment plan, you have three main options: a contract, a lease, or financing. Each option comes with its own set of terms and conditions, pros and cons, and suitability for different types of users. Understanding these differences is crucial to making an informed decision that best fits your needs and budget.

Contract Terms and Conditions

Contracts typically involve a commitment to a specific carrier for a predetermined period, usually 2 years. This commitment often comes with subsidized phone pricing, meaning the carrier offers a discounted phone price in exchange for agreeing to their service plan for the contract duration.

- Early Termination Fee (ETF): Contracts usually have an ETF that applies if you cancel your service before the contract ends. This fee can be substantial, especially if you cancel early in the contract period.

- Service Plan Requirements: Contracts typically require you to sign up for a specific service plan, which may include data, minutes, and text messaging allowances. You may be restricted in your choice of plans, and changing plans could incur additional fees.

- Limited Upgrade Options: Contracts often restrict your ability to upgrade your phone before the contract expires. You may have to pay a penalty or wait until the end of your contract to upgrade.

Lease Terms and Conditions

Smartphone leases offer a more flexible alternative to contracts. They typically involve a shorter commitment period, usually 12 to 24 months.

- Monthly Payments: You pay a fixed monthly lease payment for the duration of the lease agreement. This payment usually includes a portion of the phone’s cost and a service plan.

- Early Termination Fee: Leases typically have an ETF, but it may be lower than a contract ETF. The ETF is usually calculated based on the remaining lease payments.

- Upgrade Options: Leases usually allow you to upgrade your phone more frequently, typically every 12 months. You can return the old phone and lease a new one, often with a lower monthly payment.

- Limited Ownership: You don’t technically own the phone under a lease agreement. You are essentially renting the phone for the duration of the lease.

Financing Terms and Conditions

Smartphone financing allows you to purchase the phone outright, but you pay for it over time with a loan. This option offers more flexibility than contracts or leases, as you are not tied to a specific carrier or service plan.

- Loan Terms: Financing options typically involve a fixed monthly payment for a specific loan term, ranging from 12 to 36 months. The loan term and interest rate will affect your total cost.

- Interest Rates: Financing options often come with interest rates, which can vary depending on your credit score and the lender. The interest rate will affect your total cost.

- Ownership: You own the phone outright once you pay off the loan.

- Flexibility: Financing offers flexibility in choosing your carrier and service plan. You can switch carriers or change plans without penalty.

Pros and Cons of Each Payment Plan

Contract Pros

- Lower Upfront Cost: Contracts often offer subsidized phone pricing, making the initial cost lower.

- Predictable Monthly Payments: Contracts typically have fixed monthly payments for the duration of the contract.

Contract Cons

- Limited Flexibility: Contracts often require you to commit to a specific carrier and service plan for a set period.

- High Early Termination Fees: Contracts often have hefty ETFs, making it costly to cancel before the contract ends.

- Limited Upgrade Options: Contracts may restrict your ability to upgrade your phone before the contract expires.

Lease Pros

- More Flexibility: Leases offer more flexibility than contracts, with shorter commitment periods and upgrade options.

- Lower Upfront Cost: Leases often require a lower upfront payment than purchasing a phone outright.

Lease Cons

- Limited Ownership: You don’t own the phone under a lease agreement. You are essentially renting it.

- Higher Monthly Payments: Leases typically have higher monthly payments than contracts, as they include a portion of the phone’s cost and a service plan.

- Early Termination Fees: Leases often have ETFs, although they may be lower than contract ETFs.

Financing Pros

- Full Ownership: You own the phone outright once you pay off the loan.

- Flexibility: Financing allows you to choose your carrier and service plan without restrictions.

Financing Cons

- Higher Upfront Cost: Financing typically requires a higher upfront payment than contracts or leases.

- Interest Rates: Financing options often come with interest rates, which can add to your total cost.

- Credit Check: Financing usually requires a credit check, which may not be ideal for individuals with poor credit.

Factors Influencing Consumer Choice

Several factors can influence a consumer’s choice between contract, lease, and financing options.

- Budget: Your budget is a major factor in determining which payment plan is right for you. Contracts often have the lowest upfront cost, while financing may have the highest upfront cost.

- Credit Score: Your credit score can affect your financing options and interest rates. If you have a poor credit score, you may be limited in your financing options or face higher interest rates.

- Usage Needs: Your smartphone usage needs can also influence your choice. If you need the latest phone model every year, a lease may be a good option. If you are content with a phone for a longer period, a contract or financing may be more suitable.

- Flexibility: Consider your need for flexibility in choosing your carrier, service plan, and upgrade options. Leases and financing offer more flexibility than contracts.

- Ownership: If you prefer owning your phone outright, financing is the best option. Contracts and leases do not provide ownership.

Early Termination Fees

Early termination fees (ETFs) are a common practice in smartphone payment plans. These fees are designed to compensate carriers for the financial loss they incur when you break your contract before the agreed-upon term.

Understanding Early Termination Fees, Smartphone payment plan

Early termination fees are charges levied by carriers when you cancel your smartphone payment plan before the contract’s end date. These fees are typically calculated based on the remaining balance of the phone’s price and any associated service charges.

Factors Affecting Early Termination Fees

Several factors can influence the amount of an ETF:

* Contract Length: The longer the contract, the higher the potential ETF.

* Phone Price: More expensive phones generally have higher ETFs.

* Carrier Policies: Different carriers have varying ETF policies, so it’s crucial to compare them before signing a contract.

Potential Costs Associated with Breaking a Smartphone Payment Plan Contract

Breaking a smartphone payment plan contract can result in significant financial consequences, including:

* Early Termination Fee: This is the primary cost associated with early termination.

* Remaining Phone Balance: You might have to pay off the remaining balance of the phone’s price.

* Service Charges: You may need to pay for any outstanding service charges, such as monthly fees.

* Loss of Credit: Cancelling a contract early can negatively impact your credit score.

Tips for Avoiding Early Termination Fees

Here are some strategies to minimize the risk of incurring ETFs:

* Thoroughly Read and Understand the Contract: Pay close attention to the terms and conditions, particularly those related to early termination.

* Choose a Shorter Contract: Opting for a shorter contract term can reduce the potential ETF.

* Consider a Lease: Leasing a phone allows for more flexibility and typically involves lower ETFs.

* Shop Around for Better Deals: Compare plans and offers from different carriers to find the best value.

* Negotiate with Your Carrier: In some cases, carriers may be willing to waive or reduce the ETF.

Credit Score Impact

Smartphone payment plans can impact your credit score, just like any other type of loan or credit account. This is because many smartphone payment plans are structured as installment loans, which are reported to credit bureaus.

Credit Reporting

When you sign up for a smartphone payment plan, the lender typically reports your payment history to credit bureaus. This means that your timely payments can help build your credit score, while missed or late payments can negatively affect it.

Importance of Timely Payments

Making timely payments on your smartphone plan is crucial for maintaining a good credit score. Late payments can significantly impact your credit score, making it harder to secure loans or credit cards in the future.

- Late payments can remain on your credit report for up to seven years, affecting your credit score for an extended period.

- A lower credit score can lead to higher interest rates on loans, making it more expensive to borrow money.

Tips for Maintaining a Good Credit Score

Here are some tips for maintaining a good credit score while using a smartphone payment plan:

- Set reminders: Use calendar reminders or apps to ensure you don’t miss your payment due dates.

- Enroll in autopay: Set up automatic payments to avoid late fees and ensure timely payments.

- Monitor your credit report: Check your credit report regularly for any errors or inconsistencies.

- Pay more than the minimum: Making extra payments towards your smartphone plan can help you pay off the balance faster and improve your credit utilization ratio.

Data Usage and Overages

Data usage is a crucial factor to consider when choosing a smartphone payment plan. Your data needs will determine the plan that best suits you, and exceeding your data limits can lead to significant overage charges.

Data Usage and Payment Plans

Smartphone payment plans often come with different data allotments, ranging from a few gigabytes to unlimited data. The amount of data you need depends on your usage habits.

- Streaming videos and music consume the most data.

- Social media, browsing the web, and email use moderate amounts of data.

- Downloading apps and files can also contribute to your data usage.

Potential Costs of Data Overage

Exceeding your data limit can result in hefty overage charges. Carriers typically charge per gigabyte of data used beyond your allotted limit.

For example, a carrier might charge $10 per gigabyte for data overage. If you exceed your 10GB limit by 2GB, you would be charged an extra $20.

Tips for Managing Data Usage

- Monitor your data usage: Most smartphones and carriers offer tools to track your data usage. Regularly check your data consumption to stay within your limits.

- Use Wi-Fi whenever possible: Connect to Wi-Fi networks at home, work, or public places to avoid using your mobile data.

- Download content while on Wi-Fi: Download videos, music, and apps when connected to Wi-Fi to conserve your mobile data.

- Stream at lower resolutions: Streaming videos and music at lower resolutions can reduce data consumption.

- Limit background data usage: Turn off background data for apps that don’t require constant connectivity.

- Consider data-saving apps: There are apps available that can help compress data and reduce usage.

Insurance and Protection: Smartphone Payment Plan

Smartphones are expensive, and accidents happen. Dropping your phone, spilling liquids on it, or having it stolen can be a costly experience. This is where insurance and protection plans come in. They offer peace of mind by covering the cost of repairs or replacements in case of unexpected events.

Benefits and Drawbacks of Smartphone Insurance and Protection Plans

Insurance and protection plans for smartphones offer various benefits, but they also come with certain drawbacks.

- Benefits:

- Financial Protection: Insurance and protection plans help you avoid the financial burden of repairing or replacing a damaged or stolen phone.

- Peace of Mind: Knowing you have coverage can reduce stress and anxiety, especially if you are prone to accidents or live in a high-crime area.

- Faster Repairs or Replacements: Many plans offer expedited repair or replacement services, allowing you to get back to using your phone quickly.

- Coverage for Other Issues: Some plans extend coverage to other issues, such as accidental damage, water damage, and even screen cracks.

- Drawbacks:

- Cost: Insurance and protection plans can be expensive, especially if you have multiple devices or choose a plan with extensive coverage.

- Deductibles: You might have to pay a deductible before the insurance kicks in, which can be a significant expense.

- Limitations: Some plans have limitations on the number of claims you can make or the types of damage they cover.

- Fine Print: It’s important to carefully read the terms and conditions of the plan to understand its limitations and exclusions.

Choosing the Right Insurance or Protection Plan

Choosing the right insurance or protection plan depends on your individual needs and budget.

- Consider Your Risk Tolerance: If you are accident-prone or live in a high-crime area, you may want to consider a plan with more comprehensive coverage.

- Compare Plans and Prices: Shop around and compare different plans from various providers to find the best value for your money.

- Read the Fine Print: Pay close attention to the terms and conditions of the plan, including the deductible, coverage limits, and exclusions.

- Think About Your Device’s Value: If your phone is expensive, you may want to consider a plan with higher coverage limits.

- Check for Bundled Deals: Some providers offer discounts for bundling insurance with other services, such as wireless plans or home insurance.

Choosing the Right Plan

Choosing the right smartphone payment plan can seem daunting, but it’s a crucial step in ensuring you get the best value for your money and a device that meets your needs. There are numerous factors to consider, and understanding them will help you make an informed decision.

Factors to Consider

Before diving into specific plan options, it’s essential to consider your individual needs and priorities.

- Budget: Determine how much you can comfortably spend each month on a smartphone payment plan. Consider not only the monthly payment but also any potential upfront costs, such as a down payment or activation fees.

- Credit Score: Your credit score will influence the interest rates and financing options available to you. If you have a lower credit score, you may face higher interest rates or limited financing options.

- Data Usage: Estimate your average monthly data usage. Choose a plan with enough data to meet your needs, but avoid paying for more data than you use.

- Phone Preferences: Decide what features are most important to you in a smartphone. Consider factors like screen size, camera quality, processing power, and battery life.

Plan Comparison

Here’s a table comparing key features and costs of different smartphone payment plan options:

| Plan Type | Pros | Cons | Cost |

|---|---|---|---|

| Contract | Lower monthly payments, often bundled with other services (e.g., internet, cable) | Early termination fees, limited phone selection | Varies depending on carrier and plan |

| Lease | Lower monthly payments, upgrade options after a set period | Limited phone selection, potential for higher overall cost | Varies depending on carrier and plan |

| Financing | Flexibility in phone selection, potentially lower interest rates than credit cards | Higher monthly payments, potential for high interest rates | Varies depending on lender and interest rate |

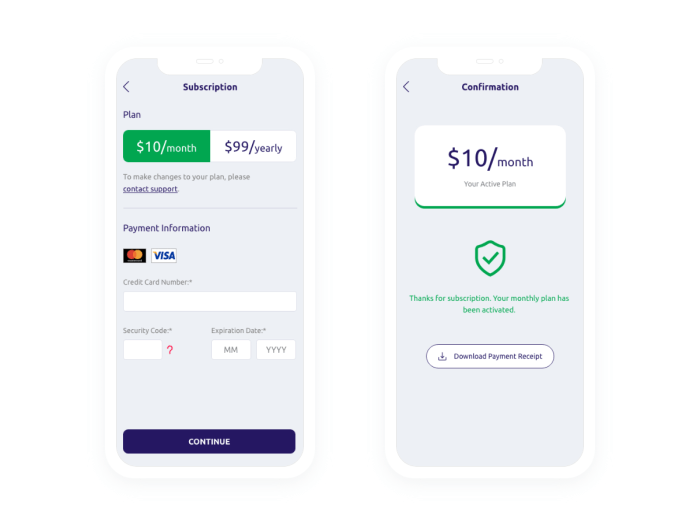

Step-by-Step Guide

Here’s a step-by-step guide to help you choose the best smartphone payment plan for your needs:

- Assess your budget: Determine your monthly budget for a smartphone payment plan, considering any potential upfront costs.

- Check your credit score: Knowing your credit score will give you an idea of the interest rates and financing options available to you.

- Estimate your data usage: Track your data usage over a few months to get a realistic estimate of your monthly needs.

- Identify your phone preferences: Decide what features are most important to you in a smartphone.

- Compare plan options: Research different carriers and compare their contract, lease, and financing options.

- Choose the best plan: Select the plan that best meets your budget, credit score, data usage, and phone preferences.

Closing Summary

Navigating the world of smartphone payment plans can be daunting, but with a thorough understanding of the available options and their associated costs, you can make informed decisions that align with your budget and preferences. By considering factors such as credit score, data usage, and phone preferences, you can choose a plan that provides the best value and enhances your mobile experience.

Informatif Berita Informatif Terbaru

Informatif Berita Informatif Terbaru