USAA bundle insurance: sounds like a win-win, right? Bundling your car, home, renters, or even life insurance might seem like a simple idea, but the potential savings and convenience are seriously worth exploring. This deep dive uncovers everything you need to know about USAA’s bundled insurance options, from comparing coverage to navigating the claims process. Get ready to become a savvy insurance shopper!

We’ll break down the nitty-gritty of USAA’s offerings, comparing them to other major players in the insurance game. We’ll even walk you through real-life scenarios to illustrate just how much you could save – or potentially lose – by bundling your policies. Think of this as your ultimate guide to making the smartest decision for your wallet and peace of mind.

USAA Bundle Insurance Overview

Source: storyblok.com

USAA, known for its unwavering commitment to serving military members and their families, offers a compelling insurance bundling option that can significantly reduce costs and simplify your financial life. By combining multiple insurance policies under one umbrella, you gain access to streamlined management, potential discounts, and a more unified approach to protecting your assets. This overview explores the specifics of USAA’s bundled insurance offerings, the savings you can expect, and who’s eligible to participate.

USAA’s bundled insurance options provide a comprehensive suite of protection tailored to the unique needs of its members. The core components typically include auto insurance, homeowners or renters insurance, and life insurance. Depending on your specific circumstances and location, you might also be able to bundle other products like motorcycle insurance, boat insurance, or even umbrella liability coverage. This flexibility allows you to customize your bundle to fit your exact requirements, maximizing your coverage while minimizing redundancy.

Potential Cost Savings of USAA Bundled Insurance

Bundling your insurance policies with USAA frequently leads to significant cost savings compared to purchasing each policy individually from different providers. The exact amount you’ll save varies depending on your specific coverage needs, location, and individual risk profile. However, USAA often offers multi-policy discounts that can amount to a substantial percentage off your total premium. For example, a member might see a 10-15% discount by bundling their auto and homeowners insurance, potentially saving hundreds of dollars annually. These savings can be even more substantial when you include additional policies like life insurance in your bundle. The key is to compare the cost of individual policies versus the bundled rate to determine the extent of your potential savings.

Eligibility for USAA Bundle Insurance

Eligibility for USAA’s bundled insurance offerings hinges primarily on membership within the USAA family. This generally includes active-duty military personnel, veterans, and their eligible family members. Specific eligibility criteria might vary slightly depending on the type of insurance policy being bundled. For instance, eligibility for homeowners insurance requires homeownership, while eligibility for auto insurance necessitates vehicle ownership and a valid driver’s license. It’s recommended to visit the USAA website or contact a USAA representative directly to confirm your eligibility and explore the specific options available to you based on your individual circumstances.

Components of a USAA Bundle

USAA’s bundled insurance packages offer a streamlined approach to protecting your assets and loved ones. By combining several insurance types into a single policy, you can often achieve cost savings and simplified management. Let’s break down the key components and what you can expect.

The exact components and coverage levels available within a USAA bundle will vary depending on your individual needs and location. However, several insurance types are frequently included, offering a comprehensive approach to risk management.

Included Insurance Types in a USAA Bundle

USAA bundles typically include a combination of auto, home, renters, and life insurance. The specific options available will depend on your individual circumstances and the state you reside in. It’s always best to contact USAA directly to get a personalized quote and understand the full range of available coverages.

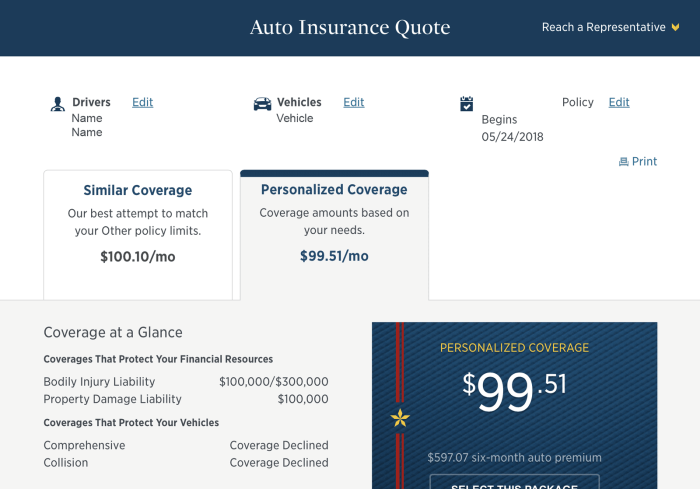

Auto Insurance Coverage Options

Auto insurance within a USAA bundle typically includes liability coverage (protecting you against claims from others), collision coverage (covering damage to your vehicle in an accident), and comprehensive coverage (covering damage from non-accident events like theft or hail). Higher coverage limits for liability and optional add-ons like uninsured/underinsured motorist coverage will influence the overall cost.

USAA’s bundled insurance offers convenience, but remember, comprehensive coverage looks different for everyone. For example, bookkeepers need specialized protection, like the errors and omissions insurance for bookkeepers to safeguard against financial mishaps. Ultimately, choosing the right USAA bundle depends on your individual risk profile and professional needs.

For example, choosing higher liability limits (e.g., $500,000 instead of $100,000) will increase your premium, but offers greater financial protection in case of a serious accident. Similarly, adding roadside assistance or rental car reimbursement can enhance your coverage but will add to the total cost.

Home and Renters Insurance Coverage Options

Homeowners insurance within a USAA bundle protects your home and belongings from damage or loss due to various perils, including fire, theft, and weather events. Renters insurance, conversely, covers your personal belongings within a rented property. Coverage levels for dwelling, personal property, and liability can be adjusted, impacting the premium.

A higher coverage amount for personal property, for instance, would protect you against greater losses in case of a fire or burglary, but will result in a higher premium. Similarly, increasing your liability coverage protects you against larger claims if someone is injured on your property (homeowners) or in your rented space (renters).

Life Insurance Coverage Options

Life insurance offered as part of a USAA bundle typically provides financial security for your beneficiaries in the event of your death. Term life insurance (coverage for a specific period) and permanent life insurance (coverage for your entire life) are common options. The amount of coverage and the type of policy chosen significantly influence the premium.

Choosing a higher death benefit, naturally, leads to a higher premium. The type of policy also matters; permanent life insurance typically has higher premiums than term life insurance, but it also offers cash value accumulation.

Impact of Coverage Levels on Bundle Cost

The overall cost of a USAA bundle is directly influenced by the chosen coverage levels for each included insurance type. Selecting higher coverage limits across the board will inevitably result in a higher premium. However, this increased cost provides enhanced financial protection. Conversely, opting for lower coverage limits will reduce the premium but also lowers the level of protection.

For example, a bundle with high liability limits on auto insurance, high dwelling coverage on homeowners insurance, and a substantial death benefit on life insurance will be significantly more expensive than a bundle with lower coverage limits across all types. It’s crucial to carefully weigh the desired level of protection against the associated cost to find the optimal balance for your financial situation.

Benefits of a USAA Insurance Bundle

Source: deshicompanies.com

Bundling your insurance policies with USAA offers a compelling value proposition that extends beyond simply saving space in your filing cabinet. It’s about streamlining your financial life and potentially saving significant money in the process. The convenience and potential cost savings make it a smart choice for many USAA members.

The primary advantage of a USAA insurance bundle lies in its ability to simplify your life and potentially lower your overall insurance costs. Managing multiple policies under one provider eliminates the hassle of juggling separate bills, renewal dates, and customer service interactions. This consolidated approach offers a significant boost to efficiency and peace of mind.

Simplified Policy Management

A single point of contact for all your insurance needs drastically reduces administrative burden. Imagine needing to file a claim – instead of navigating multiple websites and phone systems, you interact with a single USAA representative who can handle all aspects of your claim, regardless of whether it involves your auto, home, or other bundled policies. This streamlined process saves time and reduces stress, especially during already challenging situations. This convenience is particularly valuable for busy individuals who appreciate the efficiency of a centralized system.

Potential Cost Savings and Discounts

USAA frequently offers discounts to members who bundle their insurance policies. These discounts can be substantial, potentially amounting to hundreds of dollars annually depending on the specific policies bundled and the member’s individual circumstances. For example, bundling homeowners and auto insurance might result in a percentage discount on both premiums. These savings can accumulate over time, representing a significant return on the decision to bundle. Additionally, USAA’s membership-based structure and focus on its members’ needs often translate into competitive pricing even without specific bundle discounts.

Enhanced Customer Service Experience

The single-provider approach extends to customer service. Instead of explaining your situation repeatedly to different representatives from various companies, you work with a single, knowledgeable USAA agent familiar with all aspects of your insurance coverage. This consistent interaction fosters a stronger relationship with your insurer, potentially leading to more personalized service and quicker resolutions to any issues that may arise. This personalized attention can be invaluable, especially when dealing with complex or sensitive situations.

Comparison with Competitors

Choosing the right insurance bundle can feel like navigating a maze. While USAA boasts a strong reputation, understanding how its offerings stack up against other major providers is crucial for making an informed decision. This comparison focuses on key aspects of auto and home insurance bundles, highlighting differences in coverage and pricing to help you evaluate your options.

Directly comparing insurance quotes requires specific details like location, coverage levels, and vehicle information. The examples below use hypothetical averages to illustrate the general cost differences between providers. Remember to obtain personalized quotes from each company for an accurate comparison tailored to your individual needs.

Bundle Cost Comparison, Usaa bundle insurance

The following table provides a hypothetical comparison of auto and home insurance bundle costs from three major providers: USAA, State Farm, and Geico. These figures are for illustrative purposes only and should not be considered definitive quotes. Actual costs will vary based on individual circumstances.

| Provider | Auto Insurance Cost (Annual) | Home Insurance Cost (Annual) | Total Bundle Cost (Annual) |

|---|---|---|---|

| USAA | $1200 | $800 | $2000 |

| State Farm | $1400 | $900 | $2300 |

| Geico | $1300 | $750 | $2050 |

Coverage Option Differences

Beyond pricing, significant differences exist in the specific coverage options offered by each provider. For instance, USAA is known for its strong customer service and benefits tailored to military members and their families. State Farm often emphasizes a wide range of additional services and discounts, while Geico focuses on competitive pricing and a streamlined online experience. These differences extend to coverage details like liability limits, deductibles, and optional add-ons. For example, one provider might offer better coverage for specific types of damage or offer more comprehensive roadside assistance packages.

Evaluating Insurance Bundle Value

Evaluating the value of different insurance bundles requires a holistic approach. Simply focusing on the lowest price might overlook crucial coverage gaps. Consider the following factors:

First, assess your individual needs. Do you require high liability limits? Are you concerned about specific risks, like flood damage or theft? Then, compare coverage options offered by each provider, ensuring they adequately address your concerns. Finally, factor in customer service and ease of claims processing. A lower price might be negated by a frustrating claims experience.

The best insurance bundle isn’t necessarily the cheapest; it’s the one that provides the right coverage at a price you can afford, coupled with reliable service.

Customer Experience with USAA Bundles: Usaa Bundle Insurance

Source: autoinsuranceez.com

USAA’s reputation is built on more than just competitive rates; it’s deeply rooted in the exceptional experiences its members consistently report. Bundling insurance policies with USAA often enhances this positive experience, streamlining management and potentially offering cost savings. However, the actual customer journey varies, and understanding the nuances is crucial.

The overall customer experience with USAA insurance bundles is largely positive, driven by a combination of competitive pricing, robust digital tools, and highly-rated customer service. However, like any large insurance provider, individual experiences can differ based on factors such as claim complexity and personal interaction with specific representatives.

Customer Testimonials and Reviews

Understanding the real-world experiences of USAA members is key to evaluating the bundle offering. While specific testimonials are not publicly available in a consistently compiled format, numerous online forums and review sites showcase generally positive feedback, highlighting aspects like ease of use and responsive customer service.

- Many users praise the streamlined online portal for managing multiple policies, allowing for easy access to billing information, policy details, and claim status updates.

- Positive feedback frequently mentions the speed and helpfulness of USAA’s customer service representatives, particularly during the claims process.

- Several reviews highlight the convenience of having multiple policies bundled together, simplifying bill payment and policy management.

- Some users note the potential for cost savings when bundling, although the exact amount varies depending on the specific policies and individual circumstances.

- A small percentage of reviews mention occasional challenges with navigating the online portal or experiencing longer-than-expected wait times for customer service, highlighting the need for continuous improvement.

Customer Service Options for Managing a USAA Insurance Bundle

USAA offers a multi-faceted approach to customer service, ensuring members can access support through various channels. This comprehensive strategy aims to cater to diverse preferences and needs.

- Online Portal: A user-friendly online portal allows for 24/7 access to policy information, billing, claims status, and communication with USAA.

- Mobile App: The USAA mobile app mirrors the functionality of the online portal, providing convenient access on the go.

- Phone Support: Dedicated phone lines offer direct access to knowledgeable customer service representatives for assistance with policy inquiries, claims, and other matters.

- Email Support: Members can also contact USAA via email for less urgent inquiries or to provide documentation.

- In-Person Service (Limited): While primarily digital, USAA maintains some in-person service options at select locations, though these are less common than digital channels.

Filing Claims Under a USAA Bundled Insurance Policy

The claims process for bundled policies generally mirrors the process for individual policies, but the streamlined nature of the bundled account can potentially expedite certain aspects.

- Online Claim Filing: Many claims can be filed conveniently through the USAA website or mobile app.

- Phone Claim Reporting: For more complex claims or situations requiring immediate assistance, members can report claims via phone.

- Dedicated Claim Adjusters: USAA assigns dedicated claim adjusters to handle each claim, ensuring personalized attention and support throughout the process.

- Transparent Communication: USAA aims to maintain open communication throughout the claims process, keeping members informed of the progress and any necessary actions.

- 24/7 Availability: The ability to report claims 24/7 provides convenience and peace of mind in emergency situations.

Illustrative Scenarios

Let’s dive into some real-world examples showcasing the financial perks and streamlined claim processes offered by USAA’s bundled insurance options. These scenarios illustrate the benefits of choosing a USAA bundle over purchasing separate policies.

Cost Savings from Bundling Car and Home Insurance

Imagine Sarah, a homeowner with a modest car. Separately, her car insurance with another provider costs $1200 annually, and her homeowner’s insurance is $800 a year, totaling $2000. However, by bundling her car and home insurance with USAA, she receives a significant discount, bringing her total annual premium down to $1600. This represents a $400 annual savings – a substantial amount that can be used for other financial goals. This cost reduction is due to USAA’s bundled pricing strategy, which often offers discounts based on the combined risk assessment of both policies. The specific discount varies based on individual factors like location, coverage level, and claims history, but significant savings are frequently achievable.

Claim Process for Bundled Auto and Home Insurance

Consider John, a USAA customer whose home suffered damage during a severe storm, and his car was also damaged in the same event. Filing a claim was straightforward. He contacted USAA’s 24/7 claims line, provided details of the damage to both his home and car, and was assigned a single claims adjuster. This single point of contact simplified the process considerably. The adjuster inspected both the home and the car, and within three weeks, John received approval for repairs and reimbursements for both claims. The streamlined process, thanks to the bundled policy, significantly reduced the stress and administrative burden typically associated with separate claims. The timeline is an estimate, and actual processing times may vary depending on the complexity of the claims and the availability of contractors.

Comparison of Three USAA Bundle Options

Let’s compare three hypothetical USAA bundle options for different customer profiles:

| Customer Profile | Bundle Components | Estimated Annual Premium | Key Features |

|---|---|---|---|

| Single, Apartment Dweller, One Car | Auto Insurance, Renters Insurance | $1000 | Basic liability coverage, low deductible renters insurance. |

| Married Couple, Homeowners, Two Cars | Auto Insurance (2 vehicles), Homeowners Insurance | $2200 | Comprehensive auto coverage, high coverage homeowners insurance. |

| Family of Four, Homeowners, Two Cars | Auto Insurance (2 vehicles), Homeowners Insurance, Umbrella Liability | $3500 | Comprehensive auto and homeowners insurance, additional liability protection. |

Note: These premiums are estimates and will vary based on individual factors, such as location, coverage level, and claims history. The actual cost will be determined during the quoting process. The key features listed represent typical coverage levels for each profile, and specific details should be confirmed with a USAA representative.

Concluding Remarks

So, is USAA bundle insurance the right choice for you? The answer, as with most things, depends on your individual needs and circumstances. By weighing the potential cost savings against the specific coverage you require, and by comparing USAA’s offerings to those of competitors, you can make an informed decision that best protects your assets and your future. Remember, understanding your insurance is key to feeling financially secure. Happy saving!