My Insurance Portal: Imagine a world where managing your insurance is as easy as scrolling through your favorite app. No more endless phone calls, lost paperwork, or confusing jargon. That’s the promise of a well-designed My Insurance Portal, a digital space where you’re in complete control of your policy. This portal is more than just a website; it’s your personalized insurance command center, streamlining everything from filing claims to updating personal information. We’ll delve into what makes a truly great portal, exploring its features, security, and the user experience that makes it a game-changer.

This deep dive into the world of My Insurance Portal will cover everything from intuitive design and seamless navigation to robust security measures and proactive customer service. We’ll examine how a user-friendly interface can significantly improve the customer experience, transforming a potentially stressful process into a simple, efficient one. Get ready to discover how a My Insurance Portal can revolutionize your interaction with your insurance provider.

User Experience on “My Insurance Portal”

Navigating the world of insurance can feel like wading through treacle. But what if your insurance portal was less of a bureaucratic labyrinth and more of a breezy, helpful companion? That’s the goal – a user experience so smooth, you’ll actually *enjoy* interacting with your insurance. Let’s dive into how we can make that happen.

A well-designed insurance portal should prioritize ease of use and clarity. Information needs to be readily accessible, processes streamlined, and the overall experience should be stress-free. Think less paperwork, more peace of mind.

Homepage User Interface Mockup

Imagine a clean, modern homepage. We’ll use a responsive four-column layout to present key information efficiently. This layout adapts seamlessly to different screen sizes, from desktops to smartphones.

| Column 1: Quick Actions | Column 2: Account Overview | Column 3: Recent Activity | Column 4: Helpful Resources |

|---|---|---|---|

|

|

|

|

Filing a Claim User Story

Let’s walk through a typical user journey. This example focuses on the clarity and efficiency of the process.

As a policyholder, I want to file a claim easily and quickly so I can get back to my life. I start by logging into my account. On the homepage, I click the prominent “File a Claim” button. I’m guided through a simple, step-by-step form, providing necessary details about the incident. The system clearly indicates what information is required and provides helpful prompts. I upload supporting documents, receive a confirmation number, and am provided with estimated processing times. I can track the status of my claim online at any time.

My insurance portal’s got everything, from car to home, but navigating the complexities of professional insurance can be a beast. If you’re a legal eagle needing a solid safety net, check out this legal malpractice insurance quote to see how affordable peace of mind can be. Then, hop back to my portal for all your other insurance needs – because, let’s face it, life throws curveballs.

Improving Accessibility for Users with Disabilities

Inclusivity is paramount. We need to ensure our portal caters to all users, regardless of their abilities. Here are three key areas of focus:

- Keyboard Navigation: The entire portal should be fully navigable using only a keyboard. This is crucial for users who rely on assistive technologies. All interactive elements must be accessible via tab order.

- Screen Reader Compatibility: We must ensure all content is properly labeled and structured using semantic HTML. This allows screen readers to accurately convey information to visually impaired users. Alt text for images and descriptive headings are essential.

- Color Contrast: Sufficient color contrast between text and background is vital for readability, especially for users with low vision. We should adhere to WCAG guidelines for color contrast ratios to ensure optimal visibility.

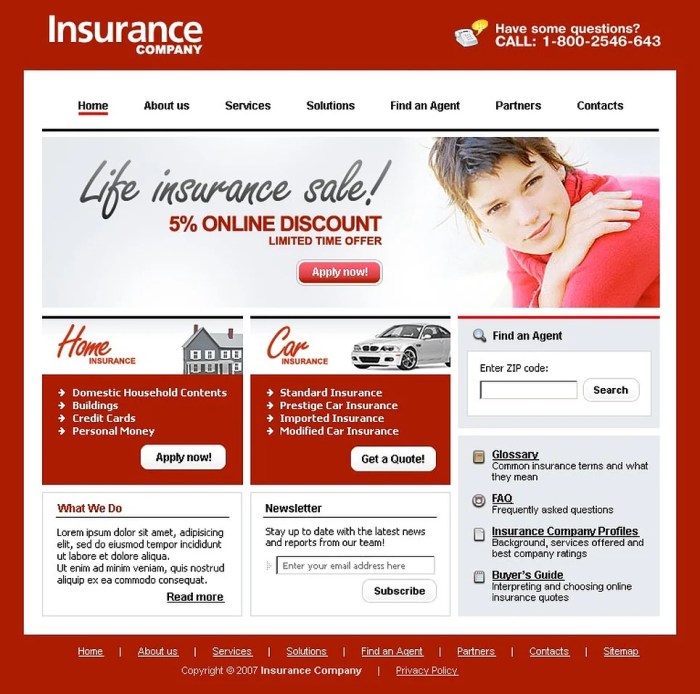

Features and Functionality of “My Insurance Portal”

Source: com.au

Let’s face it, navigating the world of insurance can feel like deciphering ancient hieroglyphs. But what if your insurance portal was actually… *useful*? A well-designed portal should be your one-stop shop for all things insurance, making managing your policies a breeze. This section dives into the essential features and functionality of a truly modern My Insurance Portal.

A modern insurance portal should streamline the often-frustrating process of managing your insurance. It should be intuitive, accessible, and provide all the information you need, when you need it. Think of it as your personal insurance concierge, available 24/7.

Essential Features Categorized by User Need

The ideal My Insurance Portal caters to various user needs, providing a comprehensive suite of tools and information. This should include features related to claims, billing, policy information, and more, all seamlessly integrated for a user-friendly experience.

- Claims: File new claims, track claim status, upload supporting documents, view claim history, and communicate with adjusters.

- Billing: View current and past bills, make payments, set up automatic payments, download payment history, and access payment methods.

- Policy Information: Access policy documents, view coverage details, make changes to policy information (address, contact details, etc.), and understand policy terms and conditions.

- Personal Information: Update personal information, manage beneficiaries, and view communication preferences.

- Communication: Secure messaging with insurance representatives, access FAQs, and find contact information.

- ID Cards: Access and download digital insurance ID cards.

Comparison of Two “My Insurance Portal” Designs

Let’s compare two hypothetical portal designs: “Portal A” and “Portal B”. Each has its strengths and weaknesses, illustrating the importance of user-centered design in insurance technology.

| Feature | Portal A | Portal B |

|---|---|---|

| Navigation | Intuitive menu, clear visual hierarchy. Easy to find information. | Cluttered interface, difficult to navigate. Information buried deep within the site. |

| Claim Filing | Streamlined process, clear instructions, online document upload. | Lengthy process, requires multiple steps and phone calls. Document upload cumbersome. |

| Payment Options | Multiple payment options available, including automatic payments and mobile wallets. | Limited payment options, primarily check or mail. No automatic payment option. |

| Customer Support | Integrated chat feature, readily available FAQs, multiple contact options. | Limited customer support, difficult to find contact information. Long wait times on the phone. |

Updating Personal Information, My insurance portal

Updating your personal information should be a straightforward process. A well-designed portal makes this easy, minimizing the potential for errors and frustration.

- Log in to your My Insurance Portal using your username and password.

- Navigate to the “My Profile” or “Personal Information” section. This is typically found in a user menu or settings area.

- Locate the specific information you wish to update (address, phone number, email address, etc.).

- Enter the corrected information and double-check for accuracy.

- Save the changes. The portal may require you to confirm the changes before saving.

- You may receive a confirmation email or message confirming the update.

Security and Privacy on “My Insurance Portal”

Your insurance information is personal and sensitive, so we get it – security and privacy are top priorities. We’ve built “My Insurance Portal” with robust measures to protect your data and give you peace of mind knowing your information is safe with us. Think of it as your digital insurance vault, fortified with cutting-edge security.

Protecting your data is paramount. We employ a multi-layered approach to security, combining advanced technologies and rigorous processes to safeguard your personal information from unauthorized access, use, disclosure, alteration, or destruction. This commitment goes beyond simply meeting industry standards; it’s about building trust and ensuring a secure online experience.

Data Encryption and Authentication Methods

Data encryption is the cornerstone of our security strategy. All data transmitted to and from “My Insurance Portal” is encrypted using industry-standard protocols like TLS/SSL, ensuring that your information remains confidential during transit. At rest, your data is also encrypted using robust encryption algorithms, further protecting it from potential breaches. Authentication is equally critical. We utilize multi-factor authentication (MFA), requiring not only a password but also a secondary verification method like a one-time code sent to your registered mobile phone or email address. This two-pronged approach makes it significantly harder for unauthorized individuals to access your account, even if your password is compromised. We also employ regular security audits and penetration testing to identify and address potential vulnerabilities proactively.

User Authentication and Authorization Process

The following flowchart illustrates the user authentication and authorization process on “My Insurance Portal”:

Imagine a flowchart. The process begins with the user entering their username and password on the login page. This information is then compared against the database of registered users. If the credentials match, the system proceeds to the second authentication factor, such as a one-time code sent via SMS or email. Upon successful verification of the second factor, the user is granted access to the portal. Authorization then determines which specific features and functionalities the user can access based on their role and policy details. For instance, a policyholder might have access to view their policy details and make payments, while an agent might have broader access to manage policies and communicate with clients. If either authentication step fails, the user is denied access, and an appropriate error message is displayed. This ensures only authorized users with verified identities can access sensitive information.

Best Practices for Ensuring User Privacy and Compliance

We are committed to maintaining user privacy and complying with all relevant data protection regulations, including GDPR, CCPA, and other applicable laws. This commitment translates into several key practices. First, we collect only the minimum necessary personal information required to provide our services. Second, we implement strict data retention policies, securely deleting data when it is no longer needed. Third, we provide users with transparent and easily accessible privacy policies, clearly outlining how we collect, use, and protect their information. Fourth, we empower users with control over their data, enabling them to access, update, and delete their information at any time. Finally, we conduct regular employee training on data privacy and security best practices to ensure our team is well-equipped to handle sensitive information responsibly. We also maintain comprehensive incident response plans to swiftly address any potential data breaches and minimize their impact.

My Insurance Portal and Customer Service

Navigating the world of insurance can feel like wading through treacle, but a well-designed online portal can be a game-changer. “My Insurance Portal” aims to simplify the process, offering easy access to your policy information and providing various avenues for seamless communication with our customer service team. We believe that accessible, responsive customer service is as important as the insurance policy itself.

Frequently Asked Questions about My Insurance Portal

We understand that you might have questions about using “My Insurance Portal.” To help you get started, we’ve compiled a list of frequently asked questions.

| Question | Answer |

|---|---|

| How do I log in to My Insurance Portal? | To log in, visit our website and click on the “My Insurance Portal” link. You’ll need your registered email address and password. If you’ve forgotten your password, click on the “Forgot Password?” link and follow the instructions to reset it. |

| What information can I access through My Insurance Portal? | You can view your policy details, including coverage limits, deductibles, and payment history. You can also update your personal information, submit claims, and view claim status. |

| How do I make a payment through My Insurance Portal? | “My Insurance Portal” allows you to make secure online payments using various methods, including credit cards, debit cards, and electronic bank transfers. Simply navigate to the “Payments” section and follow the prompts. |

| What if I need help using My Insurance Portal? | We offer several ways to get assistance. You can access our comprehensive FAQs, contact us via phone or email, or utilize the live chat feature available on the portal. |

| Is My Insurance Portal secure? | Yes, your security is our top priority. “My Insurance Portal” utilizes industry-standard encryption technology to protect your personal information. We also adhere to strict privacy policies to ensure your data remains confidential. |

Proactive Customer Service Notifications

“My Insurance Portal” goes beyond simply providing information; it actively keeps you informed. This proactive approach helps prevent missed payments and ensures you’re always aware of your policy status.

We utilize automated notifications to alert you about upcoming policy renewals, payment due dates, and other important milestones. These timely reminders, delivered via email and/or SMS, help you stay on top of your insurance needs and avoid potential lapses in coverage. For example, you’ll receive an email 30 days before your policy renewal, reminding you of the upcoming due date and providing a link to renew online. A similar notification will be sent 7 days before the payment due date.

Integrating a Live Chat Feature

Adding a live chat feature to “My Insurance Portal” enhances customer service by providing immediate support. Here’s a step-by-step guide on how we integrated this feature:

1. Selecting a Live Chat Provider: We chose a reputable provider offering features like customizable chat widgets, real-time analytics, and integration with our existing CRM system.

2. Widget Customization: We customized the chat widget to match our branding and seamlessly integrate with the portal’s design.

3. Integration with CRM: The chat platform was integrated with our Customer Relationship Management (CRM) system, allowing agents to access customer history and provide personalized assistance.

4. Agent Training: Our customer service agents underwent thorough training on using the live chat platform and handling various customer inquiries effectively.

5. Testing and Deployment: We rigorously tested the integrated live chat feature to ensure seamless functionality and a positive user experience before deploying it to the live portal. This included load testing and user acceptance testing.

Mobile Responsiveness of “My Insurance Portal”

Source: fincrew.my

Let’s face it, nobody wants to squint at their insurance details on a tiny phone screen. A smooth, mobile-friendly experience is no longer a luxury; it’s a necessity in today’s digital world. Your insurance portal needs to adapt seamlessly to any device, from the largest desktop monitor to the smallest smartphone, offering the same level of functionality and ease of use across the board. This isn’t just about convenience; it’s about accessibility and ensuring everyone can easily manage their insurance.

Creating a mobile-responsive “My Insurance Portal” involves a strategic approach to design and development. The key is to prioritize a fluid layout that adjusts to different screen sizes without sacrificing functionality or visual appeal. This means using flexible grids, responsive images, and media queries to ensure that elements resize and rearrange themselves appropriately depending on the device. The goal is a consistent user experience regardless of the platform.

Design Considerations for Mobile Responsiveness

Designing for mobile responsiveness requires careful consideration of several key aspects. First, a flexible grid system is essential. This allows content to reflow and rearrange itself dynamically based on screen size. Secondly, responsive images are crucial; they should scale proportionally without distorting the image quality. Media queries, which are CSS rules that apply based on screen size, allow developers to tailor the layout and styling for different devices. Finally, touch-optimized interactions are a must. Buttons and interactive elements need to be large enough to be easily tapped on smaller screens. Think about the finger-friendly design.

Advantages of Responsive Design over Separate Mobile and Desktop Versions

Building a single responsive website is significantly more cost-effective and efficient than maintaining separate mobile and desktop versions. Updating and maintaining one codebase is simpler and reduces development time and resources. Moreover, it ensures a consistent brand experience across all devices. A unified design language reinforces your brand identity and provides a more seamless user journey, reducing confusion and frustration for your customers. This streamlined approach also simplifies content management, allowing for easier updates and modifications across all platforms.

Common Usability Issues on Mobile Insurance Portals and Solutions

Many mobile insurance portals suffer from usability issues that frustrate users. One common problem is tiny text and buttons, making navigation difficult on smaller screens. The solution is to use larger fonts and adequately sized interactive elements. Another issue is cluttered layouts, overwhelming users with too much information at once. This can be addressed by using a clean, uncluttered design and prioritizing essential information. Poor navigation is another frequent complaint; a clear, intuitive menu system is crucial for mobile users. Finally, slow loading times can be a significant deterrent. Optimizing images and code can improve performance significantly.

Closure: My Insurance Portal

Source: tmimgcdn.com

Ultimately, a successful My Insurance Portal isn’t just about technology; it’s about putting the power back in the hands of the policyholder. By prioritizing user experience, robust security, and proactive customer service, insurance providers can create a digital hub that fosters trust, transparency, and peace of mind. A well-designed My Insurance Portal isn’t just a convenient tool—it’s a strategic investment in building stronger relationships with customers and modernizing the insurance industry. So, ditch the paperwork and embrace the digital future of insurance management.