John Hancock Gold travel insurance: Sounds fancy, right? But is it worth the splurge? We dive deep into this comprehensive travel protection plan, exploring its features, coverage, and comparing it to other options on the market. Forget stressing over unexpected travel hiccups – let’s see if John Hancock Gold is your ticket to peace of mind.

This isn’t your grandma’s travel insurance. We’ll break down the nitty-gritty details, from medical emergencies to trip cancellations, helping you decide if John Hancock Gold’s Gold plan truly shines. Think of this as your ultimate guide to navigating the world of travel insurance with confidence.

Understanding John Hancock Gold Travel Insurance

Source: advice4lifeinsurance.com

John Hancock Gold travel insurance offers comprehensive coverage designed to protect you from unexpected events while traveling. It’s a popular choice for those seeking peace of mind knowing they’re covered for a wide range of situations, from trip cancellations to medical emergencies abroad. This deep dive will explore the plan’s features, benefits, and how it stacks up against competitors.

Key Features and Benefits of John Hancock Gold Travel Insurance

John Hancock Gold typically provides coverage for trip cancellations and interruptions, medical emergencies and evacuations, lost or stolen baggage, and other travel-related mishaps. Specific benefits can vary depending on the policy details and the chosen coverage level, so always review your policy documents carefully. Key advantages often include 24/7 emergency assistance, access to a global network of medical providers, and potentially higher coverage limits compared to basic travel insurance plans. The plan aims to minimize financial losses and provide support during unforeseen circumstances while traveling.

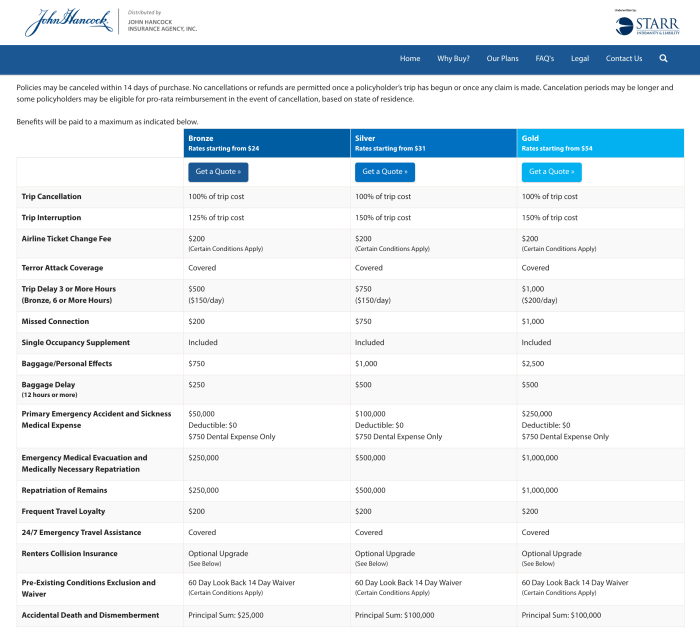

Coverage Levels within the Gold Plan

While the exact tiers and their specific inclusions may vary by year and policy, John Hancock Gold plans generally offer different levels of coverage, often categorized by premium price. Higher premiums usually correspond to increased coverage limits for medical expenses, trip cancellations, and other benefits. A lower-tier Gold plan might offer adequate coverage for shorter trips and simpler travel arrangements, whereas a higher-tier option could be better suited for longer trips, more expensive travel plans, or individuals with pre-existing medical conditions requiring more extensive coverage. Always compare the options available and choose the plan that best fits your specific needs and trip details.

Comparison with Other Travel Insurance Options

John Hancock Gold competes with numerous travel insurance providers, each offering varying levels of coverage and price points. Some competitors may offer more specialized coverage, such as adventure sports insurance or coverage for specific pre-existing conditions. Others might emphasize lower premiums, potentially at the expense of reduced coverage limits. The best option depends on your individual risk tolerance, the nature of your trip, and your budget. Direct comparison of policy documents is crucial for making an informed decision.

Comparison Table: John Hancock Gold vs. Competitors

It’s important to note that the prices and coverage details below are examples and may not reflect current offerings. Always check directly with the insurance providers for the most up-to-date information.

| Plan Name | Price (Example) | Key Benefits | Exclusions |

|---|---|---|---|

| John Hancock Gold (Example Tier) | $200 | $1,000,000 medical coverage, trip cancellation, baggage loss | Pre-existing conditions (unless specifically covered), reckless behavior |

| Competitor A (Example Plan) | $150 | $500,000 medical coverage, trip interruption | Adventure sports, pre-existing conditions |

| Competitor B (Example Plan) | $250 | $2,000,000 medical coverage, trip cancellation, baggage loss, emergency evacuation | Acts of war, pre-existing conditions (unless specifically covered) |

| Competitor C (Example Plan) | $100 | $250,000 medical coverage, basic trip interruption | Pre-existing conditions, adventure sports, alcohol-related incidents |

Coverage Details and Exclusions

John Hancock Gold travel insurance offers a comprehensive package, but understanding its specifics is key to maximizing its benefits. Knowing what’s covered and, equally important, what’s excluded, ensures you’re adequately protected during your travels. This section delves into the nitty-gritty details of John Hancock Gold’s coverage and limitations.

Medical Emergency Coverage

John Hancock Gold provides extensive medical emergency coverage, designed to handle unexpected health issues while you’re away from home. This typically includes emergency medical treatment, hospitalization, doctor visits, and medical evacuation if necessary. The policy usually sets a high coverage limit, offering significant financial protection against potentially crippling medical bills incurred abroad. Remember to check your specific policy documents for the exact coverage amount and details of what constitutes a “medical emergency.” The policy may also cover expenses related to prescription drugs needed during the emergency. It’s crucial to note that pre-existing conditions may have limitations or exclusions; always review your policy carefully before traveling.

Trip Cancellation and Interruption Coverage

Unexpected events can derail even the best-laid travel plans. John Hancock Gold helps mitigate the financial fallout from trip cancellations or interruptions due to covered reasons. These reasons typically include unforeseen circumstances like severe weather, natural disasters, or family emergencies. The policy will reimburse you for prepaid, non-refundable travel expenses, such as flights, accommodation, and tours, depending on the specifics of the event and the policy terms. The coverage amount usually has a limit, and it’s crucial to understand the definition of “covered reason” as Artikeld in your policy. For instance, a simple change of mind wouldn’t be covered, but a sudden illness requiring hospitalization might be.

Exclusions and Limitations

Like most insurance policies, John Hancock Gold has exclusions and limitations. Understanding these is vital to avoid disappointment. For example, coverage might be limited or excluded for pre-existing medical conditions, adventurous activities (like extreme sports), or activities explicitly prohibited in the policy documents. Additionally, there are often limitations on the amount of coverage for specific expenses. The policy might not cover losses due to acts of war, terrorism (depending on specific policy terms), or participation in illegal activities. It’s also important to note that the policy likely has a waiting period before coverage for certain events takes effect. Always read the fine print carefully.

Examples of Covered and Uncovered Situations

Understanding the policy through examples helps clarify its scope.

- Covered: You fall ill during your trip and require emergency hospitalization. John Hancock Gold covers your medical bills, up to the policy limit.

- Covered: A hurricane forces the cancellation of your flight, and you lose your non-refundable airfare. John Hancock Gold reimburses you for the lost airfare, subject to the policy’s terms and conditions.

- Uncovered: You decide to cancel your trip because you found a better deal elsewhere. John Hancock Gold does not cover this cancellation as it’s not due to a covered reason.

- Uncovered: You participate in an unsanctioned mountain climbing expedition and get injured. John Hancock Gold may not cover your medical expenses, as this is considered an excluded activity.

- Uncovered: You lose your passport due to negligence and incur costs to obtain a replacement. While some policies may offer limited coverage for lost documents, this is often subject to specific conditions and limits.

Purchasing and Claiming

Source: cloudfront.net

So, you’re looking at John Hancock Gold travel insurance? Smart move, securing your trip is key. But what about comprehensive coverage back home? If you’re in Alabama, check out allstate insurance prattville alabama for local options. Then, once you’ve got your home base covered, you can relax and truly enjoy that John Hancock Gold peace of mind knowing you’re protected wherever your adventures take you.

So, you’ve decided John Hancock Gold travel insurance is the right fit for your next adventure. Smart move! Now, let’s navigate the process of buying the policy and, hopefully, you’ll never need it, but just in case, how to file a claim. We’ll break it down into simple steps to make the whole thing as painless as possible.

Purchasing John Hancock Gold travel insurance is generally straightforward. You’ll typically interact with a licensed insurance agent or broker, or purchase directly through the John Hancock website (or a partner site). The process involves providing details about your trip, including dates, destinations, and the number of travelers. Be accurate and thorough; this information directly impacts your coverage. Remember, a small error can lead to significant complications down the road.

Purchasing John Hancock Gold Travel Insurance

A step-by-step guide to securing your travel insurance:

- Gather Trip Information: Compile all the necessary details about your upcoming trip, including dates, destinations, planned activities, and the number of travelers. Accurate information is key to ensuring you have the appropriate coverage.

- Find a Licensed Agent or Access the Website: Locate a licensed insurance agent or access the John Hancock website to begin the purchasing process. Many comparison websites also offer John Hancock policies.

- Complete the Application: Fill out the application form accurately and completely. This usually involves providing personal information, trip details, and answering questions about pre-existing medical conditions. Be honest and thorough in your responses.

- Review the Policy: Before finalizing the purchase, carefully review the policy document to understand the coverage details, exclusions, and limitations. Don’t hesitate to ask clarifying questions.

- Make the Payment: Complete the payment process using the accepted methods Artikeld by John Hancock. Keep a copy of your payment confirmation and policy documents for your records.

Filing a Claim with John Hancock Travel Insurance

Should the unexpected occur, here’s what you need to know about the claims process. Remember, acting quickly and providing comprehensive documentation are crucial for a smooth experience.

- Report the Incident Promptly: Notify John Hancock as soon as reasonably possible after the incident that led to your claim. The sooner you report, the faster the process can begin. Most policies have a timeframe for reporting, so adhere to it.

- Gather Necessary Documentation: Collect all relevant documentation to support your claim. This might include medical bills, police reports, flight cancellation confirmations, receipts for additional expenses, and any other pertinent documents. The more comprehensive your documentation, the easier it will be to process your claim.

- Complete the Claim Form: Complete the claim form accurately and thoroughly. Be sure to provide all the requested information and attach all supporting documentation.

- Submit Your Claim: Submit your completed claim form and supporting documentation to John Hancock via the designated method (mail, fax, or online portal). Keep a copy of everything for your records.

- Follow Up: After submitting your claim, follow up with John Hancock to check on its progress. You can contact them by phone or email, depending on their instructions.

Tips for a Smooth Claims Process

Proactive steps can significantly streamline your claims experience.

First, read your policy carefully before your trip. Understand your coverage and any exclusions. Secondly, keep all receipts and documentation related to your trip. This is crucial for supporting your claim. Third, report any incident promptly to John Hancock. Timely reporting is essential for efficient processing. Finally, be prepared to provide clear and concise explanations of the events that led to your claim. Clear communication can prevent delays.

Customer Reviews and Experiences

John Hancock Gold travel insurance, like any insurance product, receives a mixed bag of reviews. Understanding the range of customer experiences – both positive and negative – is crucial before purchasing a policy. This section summarizes common themes found in customer testimonials, comparing them to experiences reported with similar travel insurance providers. Remember, individual experiences can vary significantly.

Claims Process Experiences

The claims process is a critical aspect of any insurance policy. Many customers appreciate the straightforward nature of filing a claim with John Hancock Gold, while others report lengthy processing times or difficulties in receiving reimbursements. Customer feedback reveals a need for clearer communication throughout the claims process.

“Filing my claim was surprisingly easy. I submitted everything online and received my payment within a week.”

“The claims process was frustratingly slow. It took over a month to get my money back, and I had to make several follow-up calls.”

Customer Service Feedback

Customer service interactions significantly impact overall satisfaction. Reviews suggest that John Hancock Gold’s customer service representatives are generally helpful and responsive, but there are also reports of difficulties in reaching someone or receiving unsatisfactory responses to inquiries. A comparison with competitors reveals that response times and helpfulness are comparable, though some providers are lauded for more proactive communication.

“The customer service representative I spoke with was extremely helpful and answered all my questions thoroughly.”

“I had a difficult time reaching someone on the phone, and when I finally did, the representative was not very helpful.”

Coverage Adequacy Assessments

The adequacy of coverage is a paramount concern for travelers. Many customers find John Hancock Gold’s Gold plan offers comprehensive coverage for various travel-related emergencies and disruptions. However, some customers have reported instances where their claims were denied due to policy exclusions or ambiguities in the policy wording. Compared to competitors, the breadth of coverage appears to be in line with industry standards, although specific policy details may vary.

“The coverage was exactly what I needed. I was able to get reimbursed for my cancelled flight and hotel costs.”

“My claim was denied because the policy excluded the specific type of medical emergency I experienced. The policy wording was unclear.”

Illustrative Scenarios

Source: cloudfront.net

Understanding the value of travel insurance often comes down to real-life examples. Let’s explore scenarios where John Hancock Gold travel insurance shines and one where it falls short, highlighting the policy’s strengths and limitations. This will illustrate the crucial role of careful policy review before travel.

Scenario: Medical Evacuation in Costa Rica

Imagine Sarah, a thrill-seeking photographer, on a solo backpacking trip through Costa Rica. While hiking in a remote jungle area, she suffers a severe leg injury requiring immediate medical attention. Local medical facilities are inadequate to handle her injury. Sarah’s John Hancock Gold policy covers emergency medical evacuation. The insurance company arranges a helicopter transport to a major hospital in San José, where she receives the necessary surgery and post-operative care. The entire process, including the helicopter transport, medical bills, and repatriation to her home country, is covered by her policy, relieving Sarah of a potentially crippling financial burden. The claim process involved submitting medical bills, the helicopter transport invoice, and a completed claim form. Within a few weeks, John Hancock processed her claim, reimbursing her for all eligible expenses. This experience underscored the peace of mind that comprehensive travel insurance provides.

Scenario: Lost Luggage Due to Negligence, John hancock gold travel insurance

Now consider Mark, traveling to Europe for a business conference. He carelessly leaves his expensive laptop bag unattended at a busy train station. The bag, containing his laptop, important documents, and other valuables, is stolen. While Mark’s John Hancock Gold policy covers certain types of baggage loss, it specifically excludes losses resulting from negligence. Since Mark’s loss was a direct consequence of his own carelessness, his claim is denied. The policy clearly Artikels exclusions related to negligence, highlighting the importance of understanding the policy’s fine print before relying on it. This experience underscores the need to carefully read and understand the terms and conditions of any insurance policy.

Image Description: Medical Evacuation

The image depicts a dramatic scene: a helicopter hovering over a lush, green rainforest canopy. A stretcher, carrying a visibly injured traveler (a woman with a bandaged leg), is being carefully hoisted into the helicopter. The surrounding landscape emphasizes the remoteness of the location, highlighting the urgency and necessity of the medical evacuation. The helicopter’s markings are clearly visible, suggesting a professional medical evacuation service. The overall tone of the image conveys a sense of relief and timely intervention.

Image Description: Lost Luggage Due to Negligence

This image contrasts sharply with the previous one. It shows a dejected traveler sitting on a bench at a bustling train station, surrounded by scattered belongings – a few personal items remain, but the main luggage is missing. The traveler’s body language – slumped posture, hands covering their face – clearly communicates frustration and despair. The background is a busy train station, filled with people going about their business, oblivious to the traveler’s distress. The image subtly emphasizes the chaotic environment, implying a lack of attention and possibly contributing to the loss of the luggage. The overall feeling is one of helplessness and regret.

Ultimate Conclusion

So, is John Hancock Gold travel insurance the right fit for your next adventure? Ultimately, the answer depends on your individual needs and risk tolerance. Weighing the cost against the potential for comprehensive coverage is key. By understanding the plan’s strengths and limitations, you can make an informed decision and travel with the assurance that you’re protected against unforeseen circumstances. Happy travels!