Humana Supplemental Medicare Insurance: Navigating the complexities of Medicare can feel like decoding a secret language, but it doesn’t have to be a headache. This isn’t your grandma’s Medicare; we’re diving deep into Humana’s supplemental plans, uncovering the hidden gems (and potential pitfalls) to help you find the perfect fit. Think of us as your Medicare Sherpas, guiding you through the mountains of paperwork and confusing jargon.

We’ll break down the different types of Humana plans – Medigap, Medicare Advantage, and more – comparing costs, benefits, and network access. We’ll even spill the tea on how to navigate claims, find in-network doctors, and maximize your coverage. Get ready to become a Medicare master!

Humana Supplemental Medicare Insurance Plans

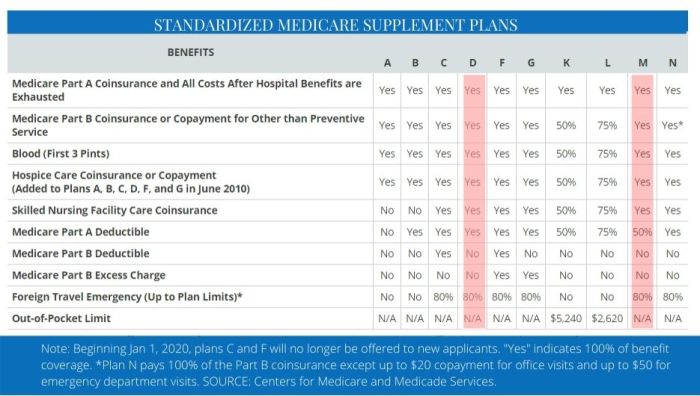

Navigating the complexities of Medicare can feel like traversing a maze, but understanding supplemental insurance options can significantly simplify the process. Humana offers a range of plans designed to bridge the gaps in Original Medicare coverage, providing additional financial protection and peace of mind for seniors. These plans fall into two main categories: Medigap and Medicare Advantage. Choosing the right plan depends on individual needs and budget.

Humana Medigap Plans

Humana Medigap plans, also known as Medicare Supplement Insurance, help cover the out-of-pocket costs that Original Medicare doesn’t. These plans are standardized by the federal government, meaning a Plan G from Humana will offer similar coverage to a Plan G from another insurer. However, premiums and specific benefits may vary slightly. They are designed to work *with* Original Medicare, not instead of it.

Humana Medicare Advantage Plans

Unlike Medigap, Humana Medicare Advantage plans (also known as Part C) are “all-in-one” plans. They replace Original Medicare’s Parts A and B coverage and often include Part D prescription drug coverage. Humana offers a variety of Medicare Advantage plans, including HMOs (Health Maintenance Organizations), PPOs (Preferred Provider Organizations), and Special Needs Plans (SNPs) designed for specific populations, such as those with chronic conditions. These plans usually have a monthly premium and may require a copay or coinsurance at the time of service.

Benefits and Coverage Differences Between Medigap and Medicare Advantage

Medigap plans offer supplemental coverage for expenses like deductibles, copayments, and coinsurance that Original Medicare doesn’t cover. They provide a predictable level of out-of-pocket expenses, making budgeting easier. Medicare Advantage plans, on the other hand, provide comprehensive coverage but often have limitations on provider choice (depending on the plan type) and may require referrals to specialists. The cost-sharing structures also differ significantly; Medicare Advantage plans typically involve copays and coinsurance, while Medigap plans cover a greater portion of out-of-pocket costs.

Humana Supplemental Medicare Plan Enrollment and Eligibility

Eligibility for Humana supplemental Medicare plans depends on several factors, including age, residency, and Medicare enrollment status. Generally, individuals must be enrolled in Medicare Part A and Part B to be eligible for a Medigap or Medicare Advantage plan. The enrollment period for Medigap plans varies, with a specific window available during the initial enrollment period (IEP). Medicare Advantage plans have an annual enrollment period (AEP) and a special enrollment period (SEP) for qualifying life events. The enrollment process usually involves applying directly through Humana, either online, by phone, or through a licensed insurance agent. It’s crucial to compare plans and understand the specific coverage details before making a decision. Consider factors such as your health needs, budget, and preferred doctors when choosing a plan.

Plan Costs and Premiums

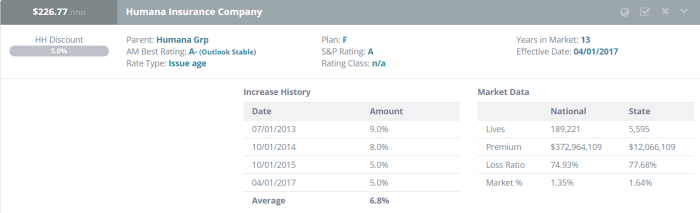

Source: redbirdagents.com

Navigating Humana supplemental Medicare insurance can feel overwhelming, especially considering the sheer number of options available. To get a better grasp of your choices, it’s helpful to understand the broader landscape of major insurance companies in Texas , as many offer Medicare plans. This broader perspective helps you compare Humana’s offerings against other significant players in the Texas Medicare market and make the best decision for your needs.

Navigating the world of Medicare supplemental insurance can feel like wading through a swamp of jargon and numbers. Understanding the costs involved is crucial before committing to a plan, and Humana offers a range of options, each with its own price tag. Let’s break down the factors influencing your premium and help you make sense of it all.

Premium costs for Humana supplemental Medicare plans aren’t one-size-fits-all. They vary significantly based on several key factors, including your age, location, and the specific plan you choose. Generally, older individuals tend to pay higher premiums, reflecting the increased likelihood of needing healthcare services. Geographic location also plays a role; plans in areas with higher healthcare costs often come with higher premiums. Finally, the level of coverage you select directly impacts the monthly cost. More comprehensive plans, naturally, will cost more.

Premium Variations Based on Age and Location

The cost of a Humana Medicare supplemental plan can differ substantially depending on your age and where you live. For instance, a 65-year-old in a rural area of Iowa might pay a lower premium for a basic plan than a 75-year-old living in a major metropolitan area like New York City. This difference reflects both the statistical likelihood of higher healthcare utilization in older age groups and the variation in healthcare provider costs across different regions. It’s essential to obtain a personalized quote from Humana based on your specific circumstances to get an accurate picture of the cost.

Premium Variations Based on Coverage Options and Deductibles

Humana offers a variety of plans with differing levels of coverage and deductibles. A plan with a lower monthly premium might have higher out-of-pocket costs, such as a higher deductible or coinsurance. Conversely, a plan with a higher premium might offer more comprehensive coverage, resulting in lower out-of-pocket expenses in the long run. Choosing the right plan requires careful consideration of your individual healthcare needs and financial situation. For example, a plan with a lower deductible might be preferable for someone anticipating significant healthcare expenses, even if it means paying a higher premium.

Sample Premium Comparison Table

The following table provides a simplified example of how premium costs can vary across different Humana plans. Remember that these are illustrative examples and actual costs will vary depending on your specific circumstances. Always contact Humana directly for accurate and up-to-date pricing information.

| Plan Name | Monthly Premium (Example) | Deductible (Example) | Key Features (Example) |

|---|---|---|---|

| Humana Plan A | $35 | $0 | Covers Part A and Part B coinsurance |

| Humana Plan F | $70 | $0 | Covers Part A and Part B coinsurance and Part B deductible |

| Humana Plan G | $60 | $198 | Covers Part A and Part B coinsurance; Part B deductible is not covered |

| Humana Plan N | $50 | $0 | Covers Part A and Part B coinsurance; some co-pays may apply |

Network Providers and Access to Care

Source: healthplans2go.com

Choosing a Humana supplemental Medicare plan involves understanding the network of healthcare providers available to you. Access to quality care hinges on selecting a plan with doctors and specialists within your network, ensuring lower out-of-pocket costs and streamlined processes. This section clarifies Humana’s provider networks and guides you through verifying your doctor’s participation.

Finding in-network doctors and specialists with Humana is a crucial step in maximizing your Medicare benefits. Humana offers various supplemental plans, each with a specific network of healthcare providers. The size and geographic reach of these networks vary depending on the plan’s type and your location. Understanding your plan’s network ensures you receive the most cost-effective and convenient care.

Humana’s Provider Network Composition

Humana’s provider networks are extensive but not all-encompassing. They include a diverse range of physicians, specialists, hospitals, and other healthcare facilities. The specific providers participating in each plan vary, and it’s essential to check the plan’s directory before enrolling. Factors such as location, plan type, and the provider’s individual participation agreements all influence network inclusion. For example, a Humana Medicare Advantage plan in a rural area might have a smaller network compared to a similar plan in a major metropolitan area. The network may also include both large hospital systems and smaller, independent practices.

Locating In-Network Doctors and Specialists

Humana provides several convenient resources to help you locate in-network doctors and specialists. The primary method is through their online provider directory. This searchable database allows you to input your location, specialty, and other criteria to identify doctors within your plan’s network. Additionally, Humana’s customer service representatives can assist you in finding in-network providers. They can provide detailed information about providers in your area and answer any questions about network participation. Finally, many Humana plans also offer a physician finder tool integrated into their mobile applications.

Verifying a Doctor’s Network Participation: A Step-by-Step Guide

- Access the Humana Provider Directory: Navigate to the Humana website and locate their online provider directory. This is usually accessible through the “Find a Doctor” or similar link on their homepage.

- Enter Your Plan Information: You will need your Humana plan ID number. This information is crucial for the directory to display the correct network for your specific plan.

- Specify Search Criteria: Input the doctor’s name, specialty, and location (city, state, or zip code). The more specific your search, the more accurate the results will be.

- Review Search Results: The directory will display a list of matching providers. Carefully review the results to confirm the doctor’s name, specialty, address, and network participation status.

- Verify Network Status: The directory will clearly indicate whether the doctor is in-network for your plan. If you are unsure, contact Humana’s customer service for clarification.

Claims and Reimbursement Procedures

Navigating the claims process with Humana’s supplemental Medicare insurance is generally straightforward, but understanding the steps involved ensures a smooth reimbursement experience. This section details the process, required documentation, and examples of common claim scenarios.

Filing a claim with Humana for your supplemental Medicare insurance typically involves submitting the necessary documentation to Humana either electronically or via mail. The specific method depends on your plan and the type of claim. Humana provides various resources to facilitate the process, including online portals and dedicated customer service lines.

Claim Submission Methods, Humana supplemental medicare insurance

Submitting a claim is easy with Humana’s multiple options. You can file claims online through their member website, a process that often involves uploading supporting documents directly. Alternatively, you can mail in a paper claim form, which can be downloaded from their website. Finally, some providers may submit claims directly to Humana on your behalf, eliminating the need for you to file anything. Choosing the most convenient method depends on your comfort level with technology and your provider’s capabilities.

Required Documentation for Claim Submission

To ensure timely processing, your claim must include specific documentation. This typically includes the original claim form, completely filled out and signed, along with supporting medical documentation. This documentation might consist of an explanation of benefits (EOB) from your original Medicare provider, receipts for services rendered, and any other relevant information such as lab reports or physician notes. Incomplete or missing documentation can delay the processing of your claim.

Common Claim Scenarios and Reimbursement Procedures

Several common claim scenarios illustrate how Humana’s supplemental Medicare insurance handles reimbursements. For instance, if you receive a bill for a covered service after seeing a network provider, you submit the bill along with the EOB from Medicare. Humana will then process the claim and reimburse you according to your plan’s coverage terms. If the provider is out-of-network, the process might be slightly more complex, potentially involving pre-authorization or a higher cost-sharing responsibility. Another common scenario involves prescription drugs. Humana’s supplemental plans often offer prescription drug coverage, and claims are typically processed based on the plan’s formulary and any applicable co-pays or co-insurance. In the event of a denied claim, Humana will typically provide a detailed explanation of the denial, outlining the reasons for denial and steps to appeal the decision.

Customer Service and Support

Navigating the world of Medicare can feel like traversing a dense jungle, but Humana aims to make the experience smoother with its comprehensive customer service offerings. Understanding how to access help and resolve issues is key to maximizing your benefits and ensuring peace of mind. This section details Humana’s various support channels and procedures to help you get the assistance you need.

Humana provides multiple avenues for customers to access support, ensuring accessibility for everyone. Whether you prefer a personal touch, the efficiency of email, or the convenience of online resources, Humana has a method tailored to your needs. Their commitment extends beyond just providing contact information; they strive to resolve issues efficiently and effectively, putting their members first.

Available Customer Service Channels

Humana offers a multi-faceted approach to customer service, recognizing that individuals have different preferences for communication. They provide phone support, email correspondence, and a robust online resource center. The phone lines are staffed with knowledgeable representatives available to answer questions and resolve issues in real-time. For those who prefer written communication, email allows for detailed inquiries and a documented record of interactions. Finally, the online resources provide self-service options, allowing members to access information and manage their accounts independently.

Humana’s Customer Support Policies and Procedures

Humana’s customer support policies emphasize prompt and efficient resolution of member issues. They aim to address inquiries within a reasonable timeframe, and their representatives are trained to handle a wide range of situations. Their procedures involve a systematic approach to problem-solving, often involving verification of information, investigation of the issue, and implementation of a solution. Should a problem require escalation, Humana has internal processes to ensure it reaches the appropriate department for resolution. Members can expect clear communication throughout the process, keeping them informed of the progress and next steps. In cases of complex or persistent issues, a dedicated case manager may be assigned to provide personalized support.

Frequently Asked Questions and Answers

Understanding common concerns can help prepare you for the process. Here are some frequently asked questions and their answers, offering insights into typical member inquiries and how Humana addresses them.

| Question | Answer |

|---|---|

| How do I find a doctor in my Humana network? | You can use the online provider directory on Humana’s website, or call their customer service number for assistance. |

| What if I have a dispute regarding a claim? | Humana Artikels a clear appeals process on their website and through their customer service representatives. This process typically involves submitting additional documentation and allowing Humana to review the claim again. |

| How can I update my personal information with Humana? | You can update your information online through your member account or by contacting Humana’s customer service department. |

| What are the payment options available? | Humana typically accepts various payment methods, including credit cards, debit cards, and electronic bank transfers. Specific options may vary depending on the plan. Contacting customer service will clarify the available options for your specific plan. |

| How do I enroll in a Humana Medicare plan? | You can enroll online through Humana’s website, during Medicare’s annual enrollment period, or by contacting a Humana sales representative. |

Comparing Humana to Competitors: Humana Supplemental Medicare Insurance

Choosing a Medicare supplemental insurance plan can feel like navigating a maze. Humana is a big player, but how does it stack up against other major providers? This section will compare Humana’s offerings to those of its competitors, focusing on key factors that influence your decision. We’ll explore cost, coverage details, and network accessibility to help you make an informed choice.

Direct comparison is crucial because Medicare supplement plans vary significantly between insurers. While Humana boasts a strong reputation and wide reach, other companies offer compelling alternatives, each with its own strengths and weaknesses. Factors such as your health needs, location, and budget play a significant role in determining which plan best suits your individual circumstances.

Humana Plan Features Compared to Competitors

To illustrate the differences, let’s compare Humana’s plans to those offered by two other leading providers: AARP (UnitedHealthcare) and Aetna. This comparison uses hypothetical examples based on average plan costs and coverage details, and it’s crucial to check current plan specifics directly with the providers. Remember that plans and pricing change frequently.

| Feature | Humana | AARP (UnitedHealthcare) | Aetna |

|---|---|---|---|

| Plan Type (Example) | Medicare Supplement Plan G | Medicare Supplement Plan G | Medicare Supplement Plan G |

| Average Monthly Premium (Example) | $150 | $140 | $165 |

| Out-of-Pocket Maximum (Example) | $0 (after Medicare Part A & B) | $0 (after Medicare Part A & B) | $0 (after Medicare Part A & B) |

| Network Size (Example – State-Specific) | Large, Nationwide Network | Large, Nationwide Network | Large, Nationwide Network, but may vary by plan |

| Prescription Drug Coverage (Example) | Requires separate Part D plan | Requires separate Part D plan | Requires separate Part D plan |

Note: These are hypothetical examples for illustrative purposes only. Actual premiums, benefits, and network sizes will vary depending on the specific plan, location, and individual circumstances. Always consult the insurer’s website or a licensed agent for the most up-to-date information.

Advantages and Disadvantages of Choosing Humana

While the table above provides a snapshot, a deeper dive into advantages and disadvantages is necessary. Humana’s broad network and established reputation are significant draws, but other providers may offer better value in specific situations.

Advantages: Humana generally offers a wide provider network, ensuring access to care in various locations. Their customer service reputation is generally positive, and they often provide a range of plan options to cater to different needs and budgets. Their online tools and resources can simplify the enrollment and claims processes.

Disadvantages: Humana’s premiums might be higher than competitors for similar plans in certain areas. The specific network of doctors and hospitals available can vary depending on your location and the chosen plan. While customer service is generally well-regarded, individual experiences can vary.

Understanding Medicare Parts A, B, and D

Navigating Medicare can feel like deciphering a complex code, but understanding the basics of Parts A, B, and D is crucial for choosing the right supplemental plan. These three parts work together (or sometimes separately, depending on your coverage) to provide a comprehensive healthcare safety net, and a Humana supplemental plan can fill in the gaps.

Medicare Part A covers inpatient hospital care, skilled nursing facility care, some home healthcare, and hospice care. Think of it as your coverage for major medical events requiring hospitalization. Part B covers doctor visits, outpatient care, some preventive services, and durable medical equipment. This is your go-to for routine checkups and managing ongoing health conditions. Part D, on the other hand, is all about prescription drug coverage. It helps pay for the medications you need to manage your health. Humana supplemental plans are designed to work alongside these parts, offering additional coverage where Medicare falls short.

Medicare Part A, B, and D Coverage Gaps

Medicare, while extensive, doesn’t cover everything. Part A has a deductible and a coinsurance requirement for longer hospital stays. Part B also requires a monthly premium and has a yearly deductible, plus coinsurance and copayments for doctor visits and other services. Part D can be particularly tricky; the infamous “donut hole” – the coverage gap – means you pay 25% of your prescription drug costs until you reach a certain spending threshold. This is where a Humana supplemental plan steps in. These plans can help cover those deductibles, copayments, and coinsurance amounts, as well as potentially closing the Part D donut hole.

Choosing the Right Humana Plan

Selecting the best Humana Medicare supplemental plan depends on your individual needs and circumstances. Consider your health history, the frequency of your doctor visits, and your prescription drug usage. For instance, someone with multiple chronic conditions requiring frequent doctor visits and expensive medications will likely benefit from a plan with robust coverage for Part B services and Part D prescription drugs. Conversely, someone with generally good health and limited prescription needs might find a less comprehensive plan sufficient. Humana offers a variety of plans with different coverage levels and premium costs, allowing you to find the best fit for your budget and healthcare requirements. Carefully reviewing the plan details, including what’s covered and what’s not, is crucial before making a decision. Comparing several plans side-by-side, using Humana’s online tools or speaking with a licensed insurance agent, is highly recommended.

Illustrative Scenarios

Understanding the real-world impact of a Humana supplemental Medicare plan is best done through concrete examples. These scenarios illustrate how a supplemental plan can significantly reduce out-of-pocket expenses in common healthcare situations.

Hospitalization with Humana Supplemental Coverage

Let’s imagine Sarah, a 67-year-old Humana Medicare Advantage member, experiences a serious fall, requiring a five-day hospital stay. Without supplemental coverage, Medicare Part A (hospital insurance) covers a significant portion of her hospital bill, but she still faces substantial co-pays and deductibles. Assume her hospital stay costs $50,000. Medicare Part A covers $40,000, leaving a $10,000 balance. With her Humana supplemental plan, which includes a robust hospital indemnity benefit, her out-of-pocket costs are dramatically reduced. The supplemental plan covers $8,000 of the remaining balance, leaving Sarah with only a $2,000 copay. This is a significant savings compared to the $10,000 she would have owed without supplemental coverage.

Prescription Drug Costs with Part D Enhancement

Consider John, a 72-year-old with a Humana Medicare Advantage plan that includes Part D prescription drug coverage. He takes several medications, including Lipitor ($100/month), a common statin, and Januvia ($150/month), a diabetes medication. Without a supplemental plan, John might face significant costs in the coverage gap (the “donut hole”) of his Part D plan, where he pays a larger percentage of his drug costs. A Humana supplemental plan, however, could significantly reduce or eliminate his out-of-pocket expenses in this coverage gap. For instance, the supplemental plan might cover 75% of his costs during the coverage gap, effectively reducing his monthly medication expenses by hundreds of dollars. This ensures he can afford his essential medications without financial strain. The exact savings would depend on the specific supplemental plan and the formulary, but the overall effect is a considerable reduction in his prescription drug costs.

Conclusion

Source: simplifiedsenior.com

So, are you ready to conquer Medicare? Choosing the right Humana Supplemental Medicare Insurance plan is a crucial step in securing your health and financial future. Remember, understanding your options is half the battle. By carefully considering your needs, comparing plans, and utilizing the resources available, you can confidently select a plan that provides the coverage and peace of mind you deserve. Don’t let Medicare intimidate you – take control and choose wisely!