How much is auto insurance in Massachusetts? That’s the burning question on every driver’s mind, especially in a state known for its unique blend of urban hustle and charming countryside. The cost isn’t a one-size-fits-all answer; it’s a wild rollercoaster ride influenced by factors as diverse as your driving history, the type of car you own, and even where you park it. Buckle up, because we’re about to navigate the twists and turns of Massachusetts auto insurance pricing.

From understanding the minimum coverage requirements to uncovering hidden discounts, we’ll break down everything you need to know to find the best deal. We’ll explore how factors like your age, driving record, and location play a crucial role in determining your premium. Think of this as your ultimate survival guide to conquering the world of Massachusetts auto insurance.

Factors Influencing Auto Insurance Costs in Massachusetts: How Much Is Auto Insurance In Massachusetts

Source: cloudinary.com

Securing affordable auto insurance in Massachusetts depends on a complex interplay of factors. Understanding these elements is crucial for drivers seeking to manage their premiums effectively. This section delves into the key determinants of auto insurance costs within the state, providing insights into how various aspects of your profile and circumstances can impact your premiums.

Driver Demographics

Age significantly impacts insurance costs. Younger drivers, particularly those under 25, generally face higher premiums due to statistically higher accident rates. Insurance companies perceive them as higher risk. Conversely, experienced drivers with a clean record often qualify for lower rates, reflecting their lower likelihood of accidents. Gender can also be a factor, although its influence is less pronounced than age. Marital status sometimes plays a role, with married individuals occasionally receiving slightly lower rates, possibly reflecting a perception of increased responsibility.

Vehicle Type

The type of vehicle you drive directly influences your insurance premiums. High-performance cars, luxury vehicles, and vehicles with a history of theft or accidents typically command higher premiums due to increased repair costs and higher risk of theft or damage. Conversely, smaller, less expensive cars often come with lower insurance rates. Vehicle safety features, such as anti-lock brakes and airbags, can also affect premiums; cars with advanced safety features may receive discounts.

Driving History

Your driving record is a cornerstone of auto insurance pricing. Accidents, traffic violations, and even at-fault accidents significantly increase premiums. A clean driving record, conversely, often results in lower premiums and even discounts. The severity of violations also matters; a DUI or reckless driving conviction will have a far more substantial impact on your rates than a minor speeding ticket. The number of years of driving experience without incidents is also a positive factor.

Geographic Location

Location within Massachusetts substantially impacts auto insurance rates. Urban areas generally have higher rates due to increased traffic congestion, higher likelihood of accidents, and higher rates of vehicle theft. Rural areas tend to have lower rates due to lower accident frequency and reduced risk of theft. Specific neighborhoods within cities can also show significant rate variations based on crime statistics and accident history.

Impact of Different Driver Profiles

| Factor | Description | Impact on Cost | Example |

|---|---|---|---|

| Age | Driver’s age | Higher for younger drivers; lower for older, experienced drivers | 20-year-old driver: higher premium; 50-year-old driver with clean record: lower premium |

| Driving Record | History of accidents and violations | Higher for poor record; lower for clean record | Multiple accidents: significantly higher premium; no accidents in 5 years: lower premium, potential discounts |

| Vehicle Type | Make, model, and safety features | Higher for expensive, high-performance cars; lower for economical vehicles | Sports car: higher premium; fuel-efficient sedan: lower premium |

| Location | Geographic area of residence | Higher in urban areas; lower in rural areas | Boston resident: higher premium; rural resident: lower premium |

Types of Auto Insurance Coverage in Massachusetts

Navigating the world of auto insurance in Massachusetts can feel like driving through a Boston traffic jam – confusing and potentially costly. Understanding the different types of coverage available is crucial to protecting yourself and your wallet. This section breaks down the key coverages, the state’s minimum requirements, and helps you determine what’s right for your individual needs.

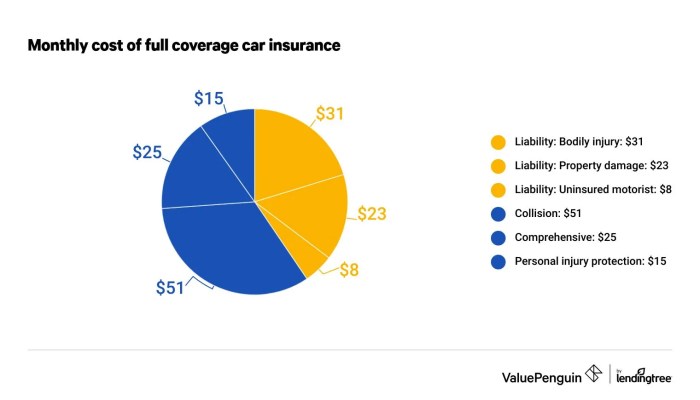

Liability Coverage

Liability insurance protects you financially if you cause an accident that injures someone or damages their property. It covers the medical bills, lost wages, and property repair costs of the other party. Massachusetts mandates a minimum liability coverage of 20/40/10, meaning $20,000 per person for bodily injury, $40,000 total for bodily injury per accident, and $10,000 for property damage. Higher liability limits are strongly recommended, as a serious accident could easily exceed these minimums, leaving you personally liable for the difference. Failing to carry adequate liability insurance could result in significant financial ruin and legal repercussions.

Collision Coverage

Collision coverage pays for repairs to your vehicle if it’s damaged in an accident, regardless of who is at fault. This means even if you cause the accident, your insurance will help cover the costs of fixing your car. While not legally required, it’s a smart investment to protect your financial investment in your vehicle. Consider the age and value of your car when deciding if this coverage is worth the cost. A newer, more expensive vehicle might warrant the higher premium for collision coverage.

Comprehensive Coverage

Comprehensive coverage protects your vehicle against damage caused by events other than collisions, such as theft, vandalism, fire, hail, or even hitting a deer. This broader protection covers a wider range of incidents that could leave you with costly repairs. Unlike liability and collision, comprehensive coverage is optional. However, if your car is relatively new or has a high value, this coverage can be a wise choice.

Uninsured/Underinsured Motorist Coverage

This critical coverage protects you if you’re involved in an accident caused by an uninsured or underinsured driver. In Massachusetts, many drivers operate without sufficient insurance. Uninsured/underinsured motorist coverage will help cover your medical bills, lost wages, and vehicle repairs if you are injured by a driver who doesn’t have enough insurance to cover your losses. This is particularly important given the potential for significant medical expenses in the aftermath of a car accident. It’s a vital layer of protection beyond the minimum liability requirements.

Minimum Coverage Requirements in Massachusetts

Massachusetts law mandates minimum liability coverage. It’s essential to understand these requirements to avoid legal penalties.

- Bodily Injury Liability: $20,000 per person, $40,000 per accident

- Property Damage Liability: $10,000 per accident

It’s important to note that these minimums are often insufficient to cover the costs associated with serious accidents. Consider purchasing higher limits to protect yourself from significant financial liability.

Benefits and Drawbacks of Each Coverage Type

Choosing the right auto insurance coverage involves weighing the benefits and drawbacks of each option. This decision should be based on your individual circumstances and risk tolerance.

| Coverage Type | Benefits | Drawbacks |

|---|---|---|

| Liability | Protects you financially if you cause an accident. | Doesn’t cover your vehicle damage. Minimum limits may be insufficient. |

| Collision | Covers your vehicle damage in an accident, regardless of fault. | Can be expensive, especially for newer vehicles. |

| Comprehensive | Covers damage from non-collision events. | Can be expensive, especially for high-value vehicles. |

| Uninsured/Underinsured Motorist | Protects you if hit by an uninsured or underinsured driver. | Additional cost, but crucial protection in a high-risk environment. |

Scenarios Where Each Coverage Would Be Beneficial

Understanding when each coverage type comes into play is vital.

- Liability: You rear-end another car, causing injuries and property damage.

- Collision: You lose control of your car and hit a tree.

- Comprehensive: A tree branch falls on your car during a storm.

- Uninsured/Underinsured Motorist: An uninsured driver runs a red light and hits your car, causing injuries.

Obtaining Auto Insurance Quotes in Massachusetts

Shopping for auto insurance in Massachusetts can feel like navigating a maze, but armed with the right knowledge, you can find a policy that fits your budget and needs. Getting multiple quotes is crucial to securing the best deal. This involves understanding the various methods available and effectively comparing the offers you receive.

Methods for Obtaining Auto Insurance Quotes

Several avenues exist for obtaining auto insurance quotes in Massachusetts. Choosing the right method depends on your comfort level with technology and your preference for personal interaction. Each method offers its own advantages and disadvantages.

- Online Comparison Tools: Websites like The Zebra, NerdWallet, and Policygenius allow you to compare quotes from multiple insurers simultaneously. This saves time and effort, providing a convenient overview of available options. However, these sites may not include every insurer operating in Massachusetts.

- Directly Contacting Insurance Agents: Reaching out to insurance agents directly provides a personalized experience. Agents can answer your questions, explain policy details, and help you choose the coverage that best suits your individual circumstances. This approach requires more time investment but allows for a deeper understanding of your options.

- Insurer Websites: Many insurance companies, such as Geico, State Farm, and Liberty Mutual, offer online quote tools on their websites. This allows you to directly compare options from a single provider, but it doesn’t provide a comprehensive market overview.

Comparing Auto Insurance Quotes Effectively

Once you’ve gathered several quotes, comparing them effectively is key to making an informed decision. Don’t just focus on the price; consider the coverage details and policy features.

- Coverage Levels: Ensure all quotes offer the same level of coverage (liability, collision, comprehensive, etc.). Comparing apples to oranges will lead to inaccurate conclusions.

- Deductibles: Higher deductibles usually mean lower premiums, but you’ll pay more out-of-pocket in case of an accident. Find a balance that suits your risk tolerance and financial situation.

- Discounts: Check for available discounts such as good driver discounts, bundling discounts (home and auto), or discounts for safety features in your vehicle. These can significantly impact your final premium.

- Customer Service Ratings: Research the insurers’ customer service ratings and reviews. A low price is meaningless if you can’t easily file a claim or get help when needed.

- Policy Details: Carefully review the policy documents for any exclusions or limitations. Understanding the fine print is crucial to avoid surprises later.

Comparison of Online Quote Comparison Websites

The following table compares some key features of popular online auto insurance comparison websites. Remember that the availability of insurers and specific features may vary over time.

| Website | Number of Insurers | Ease of Use | Additional Features |

|---|---|---|---|

| The Zebra | Many major insurers | Generally user-friendly | Detailed policy comparisons, ratings |

| NerdWallet | Wide range of insurers | Intuitive interface | Financial advice tools, articles |

| Policygenius | Several major insurers | Straightforward process | Life insurance options, other financial products |

Discounts and Savings on Auto Insurance in Massachusetts

Source: techatlast.com

Figuring out how much auto insurance costs in Massachusetts can be a real headache. To get a handle on premiums, it helps to know who’s at the top of the game; checking out who is the top three insurance company is a great starting point. Understanding their market share can give you a better idea of average costs and potentially help you find the best deal for your Massachusetts auto insurance.

Securing affordable auto insurance in Massachusetts is a priority for many drivers. Fortunately, several discounts can significantly reduce your premium. Understanding these discounts and how they apply to your specific situation can lead to substantial savings. Let’s explore the common discounts available and how to maximize your potential savings.

Good Driver Discounts

Maintaining a clean driving record is key to unlocking significant savings. Insurance companies reward drivers with a history of safe driving by offering good driver discounts. These discounts typically reflect a lower risk profile, translating to a lower premium. Eligibility usually requires a specified period without accidents or moving violations, the exact timeframe varying between insurers. For instance, a driver with five years of accident-free driving might receive a 10% discount, while ten years could yield a 15% discount. The specific percentage and eligibility criteria are determined by each insurance company’s individual policies.

Bundling Discounts, How much is auto insurance in massachusetts

Bundling your auto insurance with other insurance policies, such as homeowners or renters insurance, is another effective way to save. Many insurers offer discounts for bundling, recognizing the loyalty and reduced administrative costs associated with multiple policies under one account. For example, bundling your auto and homeowners insurance might result in a 15-20% discount on your auto premium. The exact discount percentage depends on the specific policies and the insurer.

Safe Driver Discounts

Beyond accident-free driving, some insurers offer discounts for participation in safe driving programs or the use of telematics devices. These devices track your driving habits, such as speed, braking, and acceleration. Data indicating safe driving behaviors can lead to discounts. For example, consistent safe driving habits tracked by a telematics device might earn a 5-10% discount. Eligibility depends on the insurer’s specific program requirements and your driving record as monitored by the device.

Illustrative Savings Calculation

Let’s imagine a base auto insurance premium of $1200 annually. Applying various discounts cumulatively could significantly reduce this cost:

* Good Driver Discount (15%): $1200 * 0.15 = $180 savings

* Bundling Discount (10%): ($1200 – $180) * 0.10 = $102 savings

* Safe Driver Discount (5%): ($1200 – $180 – $102) * 0.05 = $45.90 savings

Total Savings: $180 + $102 + $45.90 = $327.90

Final Premium: $1200 – $327.90 = $872.10

This example demonstrates the potential for substantial savings by combining multiple discounts. The exact amounts will vary based on the specific discounts offered by your insurer and your eligibility.

Visual Representation of Cumulative Savings

Imagine a bar graph. The initial bar represents the full $1200 premium. Subsequent bars would progressively decrease in length, representing the premium after each discount is applied. The final, shortest bar would depict the significantly reduced premium of $872.10 after applying all three discounts. This visual would clearly show the cumulative effect of the discounts in lowering the overall cost.

Understanding Your Auto Insurance Policy in Massachusetts

Navigating the world of auto insurance can feel like deciphering a foreign language, especially when faced with the dense legal jargon of your policy document. Understanding your policy isn’t just about avoiding surprises; it’s about ensuring you have the right coverage at the right price. This section breaks down the key components of a standard Massachusetts auto insurance policy, helping you become a more informed and empowered consumer.

Your auto insurance policy is a legally binding contract outlining the agreement between you and your insurance company. It details the specific coverage you’ve purchased, the terms and conditions governing that coverage, and your responsibilities as a policyholder. A thorough understanding of this document is crucial for protecting your financial interests in the event of an accident or other covered incident.

Policy Information and Declarations

This section of your policy provides essential information about your coverage. It includes your name and address, the policy number, the dates of coverage, the vehicles covered, and the drivers listed on the policy. Crucially, it also specifies the types and limits of coverage you’ve purchased (e.g., liability limits, uninsured/underinsured motorist coverage, collision and comprehensive coverage). Think of this as the summary page – the snapshot of your insurance plan. Misunderstandings here can lead to costly surprises later, so pay close attention to the details. For example, a policy might show liability limits of 100/300/50, indicating $100,000 for injury to one person, $300,000 for injuries to multiple people in a single accident, and $50,000 for property damage.

Coverage Details

This section explains the specifics of each type of coverage included in your policy. It Artikels what events are covered, what is excluded, and the process for filing a claim. For instance, your collision coverage will detail what constitutes a collision, the deductible you’ll have to pay, and the process for getting your vehicle repaired or replaced. Comprehensive coverage, on the other hand, will address non-collision events such as theft, vandalism, or damage caused by weather. Carefully reading these descriptions is essential to understanding the scope of your protection.

Terms and Conditions

The terms and conditions section Artikels your responsibilities as a policyholder. This includes things like notifying your insurer promptly in the event of an accident, cooperating fully with investigations, and maintaining accurate information about your vehicle and driving record. Failure to comply with these terms could jeopardize your coverage. This section might also address issues such as premium payments, policy cancellation, and dispute resolution.

How to Interpret Your Policy

Insurance policies are often written in complex legal language. Don’t hesitate to contact your insurer if anything is unclear. Many insurers provide policy summaries or offer to explain the key elements of your coverage over the phone. Take your time, read carefully, and don’t be afraid to ask questions. Remember, this is a contract that protects your financial well-being; understanding it fully is vital.

Questions to Ask Your Insurance Provider

Before signing on the dotted line, or even after receiving your policy, it’s crucial to have a clear understanding of your coverage. Here are some key questions to ask your insurance provider to ensure complete understanding of your policy:

- What are my specific coverage limits for liability, uninsured/underinsured motorist, collision, and comprehensive coverage?

- What is my deductible for each type of coverage?

- What is the process for filing a claim in case of an accident or other covered event?

- What are the specific circumstances under which my coverage might be denied or reduced?

- Are there any exclusions or limitations on my coverage that I should be aware of?

- What are my responsibilities as a policyholder in the event of a claim?

- What are the options for paying my premiums?

- What is the policy cancellation process, and under what circumstances might my policy be cancelled?

- What are my options for resolving disputes with the insurance company?

- How can I update my policy information, such as adding a driver or changing my address?

Final Thoughts

Source: ramseysolutions.net

So, how much *is* auto insurance in Massachusetts? The answer, as we’ve discovered, is far from simple. It’s a personalized journey influenced by a multitude of factors. By understanding these factors – from your driving history to your car’s safety features – you can arm yourself with the knowledge to shop smart and find the best coverage at a price that fits your budget. Remember to compare quotes, explore discounts, and read your policy carefully. Happy driving (and saving!).