Cheap best auto insurance – sounds like an oxymoron, right? We all want affordable coverage, but “cheap” often means skimping on essential protection. This guide navigates that tricky balance, exploring how to find the best auto insurance without breaking the bank. We’ll dissect the factors that inflate premiums, reveal strategies to slash your costs, and help you understand exactly what kind of coverage you *really* need. Get ready to become a savvy insurance shopper.

From understanding the fine print to leveraging discounts and comparing quotes effectively, we’ll arm you with the knowledge to make informed decisions. This isn’t about settling for the bare minimum; it’s about maximizing your coverage while minimizing your expenses. Let’s dive in and find your perfect fit.

Defining “Cheap Best Auto Insurance”

Finding the “cheap best” auto insurance is a classic case of wanting it all. The reality is, these two desires often clash. While everyone wants affordable coverage, sacrificing quality for price can leave you financially vulnerable in the event of an accident. Understanding this inherent tension is key to making an informed decision.

The factors consumers weigh when choosing between cheap and best insurance are highly personal. Budget constraints naturally play a significant role; a recent college graduate might prioritize affordability above all else, while a high-net-worth individual might focus more on comprehensive coverage regardless of cost. Lifestyle also impacts the decision. A driver with a spotless record and a low-mileage vehicle might feel comfortable with a more basic, budget-friendly policy, while someone who frequently drives long distances or lives in a high-risk area might need more robust protection, even if it’s more expensive.

Factors Influencing Auto Insurance Premiums, Cheap best auto insurance

Several insurance features often come with higher premiums. These include comprehensive and collision coverage, which protect your vehicle against damage from non-accidents (like hail or vandalism) and accidents respectively. Uninsured/underinsured motorist coverage, which protects you if you’re hit by a driver without sufficient insurance, also tends to be more expensive. Adding multiple drivers to a policy, especially younger or inexperienced drivers, will typically increase the premium. Similarly, choosing a higher liability limit, which determines the maximum amount the insurer will pay for damages you cause to others, will increase your costs. Finally, selecting optional add-ons like roadside assistance or rental car reimbursement will also inflate the premium.

Comparison of Auto Insurance Coverage and Costs

The cost of auto insurance varies significantly depending on coverage type, location, driving history, and other factors. The following table provides a general overview of typical cost ranges and influencing factors. Note that these are estimates and actual costs can vary widely.

| Coverage Type | Description | Typical Cost Range (Annual) | Factors Affecting Cost |

|---|---|---|---|

| Liability | Covers injuries and damages to others in an accident you cause. | $300 – $1500 | State minimum requirements, driving record, age, location |

| Collision | Covers damage to your vehicle in an accident, regardless of fault. | $300 – $1000 | Vehicle value, deductible, driving record, age |

| Comprehensive | Covers damage to your vehicle from non-accident events (theft, vandalism, weather). | $200 – $800 | Vehicle value, deductible, location (theft rates) |

| Uninsured/Underinsured Motorist | Protects you if hit by an uninsured or underinsured driver. | $100 – $500 | State requirements, driving record, location |

| Medical Payments | Covers medical expenses for you and your passengers, regardless of fault. | $100 – $400 | State requirements, number of passengers |

Factors Affecting Auto Insurance Costs

So, you’re hunting for the cheapest best auto insurance? Great! But the price tag isn’t just plucked from thin air. Several factors play a significant role in determining your premium. Understanding these factors can help you snag a better deal. Let’s dive into the details.

Demographic Factors and Insurance Premiums

Your personal characteristics significantly influence your insurance rate. Insurers use statistical data to assess risk, and certain demographics are statistically associated with higher accident rates. Age, driving history, and location are key players here. Younger drivers, for example, often have less experience and are statistically more likely to be involved in accidents, leading to higher premiums. A clean driving record, on the other hand, demonstrates lower risk and can result in lower costs. Similarly, your location matters because areas with higher crime rates or more frequent accidents tend to have higher insurance premiums. Think of it like this: Insurers are essentially betting on your likelihood of filing a claim.

Vehicle Type and Features Impact on Insurance Costs

The car you drive is another major factor. Luxury cars, sports cars, and high-performance vehicles are generally more expensive to insure because of their higher repair costs and the potential for more severe damage in an accident. Think about it: Replacing a Ferrari’s engine is far more costly than replacing a Honda Civic’s. Beyond the make and model, certain features also influence premiums. Advanced safety features like anti-lock brakes (ABS), electronic stability control (ESC), and airbags can sometimes qualify you for discounts, as they reduce the risk of accidents and the severity of injuries. Conversely, vehicles with easily replaceable parts or a history of fewer repairs might come with lower premiums.

Driving Habits and Claims History Influence Premiums

Your driving habits significantly impact your insurance rates. A history of accidents or traffic violations will almost certainly increase your premiums. Insurers view this as a higher risk profile. Even minor infractions can add up over time. Conversely, maintaining a clean driving record, demonstrating responsible driving habits, and avoiding at-fault accidents can significantly lower your premiums. Furthermore, the frequency of your driving can affect your premiums. Someone who commutes daily might pay more than someone who only drives occasionally.

Discounts Offered by Insurance Companies

Insurance companies offer various discounts to incentivize safe driving and loyalty. These discounts can significantly reduce your premiums. Common discounts include safe driver discounts (for accident-free driving records), bundling discounts (for combining auto and homeowners or renters insurance), good student discounts (for students maintaining a certain GPA), and multi-car discounts (for insuring multiple vehicles under the same policy). Some companies even offer discounts for installing anti-theft devices or completing defensive driving courses. It pays to shop around and ask about available discounts.

Finding Affordable Auto Insurance Options: Cheap Best Auto Insurance

Source: businessparagon.com

Finding the best and cheapest car insurance can feel like navigating a maze, but with a little savvy and the right approach, you can significantly reduce your premiums without sacrificing essential coverage. This section Artikels a strategic plan to help you find affordable auto insurance that fits your needs and budget.

The key is to be proactive and informed. Don’t just settle for the first quote you receive; instead, take the time to compare multiple options and understand the factors that influence your insurance cost. Remember, the cheapest isn’t always the best – you need a policy that offers adequate protection while remaining budget-friendly.

Comparing Auto Insurance Quotes Effectively

Effectively comparing auto insurance quotes requires a systematic approach. Don’t just focus on the price; consider coverage, deductibles, and customer service ratings. A step-by-step guide will help you navigate this process efficiently.

Hunting for cheap best auto insurance? Finding the right balance between affordability and coverage is key. To help you navigate this, check out who is the top three insurance company to see if your preferred provider makes the cut. Once you know the top players, comparing their rates for cheap best auto insurance becomes a breeze, saving you money and stress.

- Gather Your Information: Before you start, collect all the necessary information, including your driver’s license, vehicle information (make, model, year), and your driving history. Accurate information is crucial for receiving accurate quotes.

- Use Online Comparison Tools: Several websites allow you to compare quotes from multiple insurers simultaneously. Enter your information once, and the site will provide a range of options. Popular examples include sites like The Zebra, NerdWallet, and Insurify.

- Contact Multiple Insurers Directly: While comparison websites are helpful, contacting insurers directly can sometimes uncover additional discounts or specialized programs not listed online. This allows for personalized interactions and potential for better negotiation.

- Compare Apples to Apples: Ensure that the quotes you’re comparing offer similar coverage levels. Don’t just focus on the premium; look at the liability limits, collision and comprehensive coverage, and other features.

- Consider Deductibles: Higher deductibles (the amount you pay out-of-pocket before insurance kicks in) typically result in lower premiums. Weigh the risk and financial implications before choosing a deductible.

- Check Customer Reviews and Ratings: Before committing, research the insurers you’re considering. Check online reviews and ratings from sources like the Better Business Bureau to gauge their reputation for customer service and claims handling.

Resources for Finding Cheap Auto Insurance

Several resources can assist in your search for affordable auto insurance. Utilizing these resources can broaden your options and potentially lead to significant savings.

- Comparison Websites: As mentioned above, sites like The Zebra, NerdWallet, and Insurify allow you to compare quotes from numerous insurers in one place.

- Independent Insurance Agents: These agents represent multiple insurance companies, allowing them to shop around for the best rates on your behalf. They can often access discounts and policies not available directly through the insurer’s website.

- Direct-to-Consumer Insurers: Companies like Geico, Progressive, and State Farm offer online quotes and direct purchasing options, often streamlining the process.

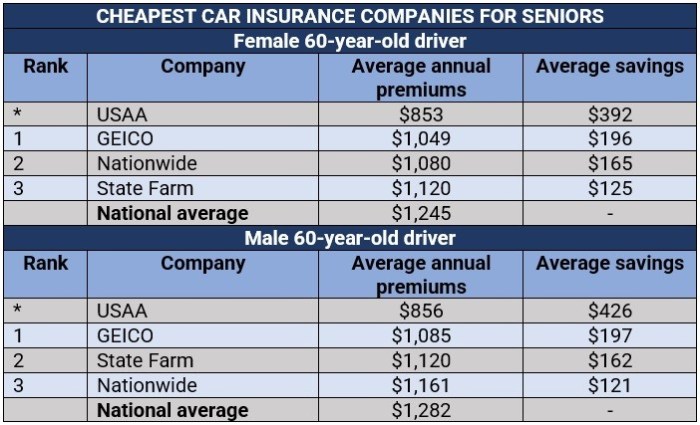

- Insurers Specializing in Certain Demographics: Some insurers cater to specific groups, such as young drivers, seniors, or those with specific driving records. Researching these options might reveal better rates.

Importance of Reading Policy Details Carefully

Before signing on the dotted line, meticulously review the policy documents. Overlooking crucial details can lead to unexpected costs and inadequate coverage when you need it most.

Pay close attention to the coverage limits, deductibles, exclusions, and any additional fees or surcharges. Don’t hesitate to contact the insurer to clarify anything you don’t understand. A clear understanding of your policy’s terms and conditions is paramount.

Advantages and Disadvantages of Various Insurance Company Types

Choosing between large national companies and regional providers involves weighing several factors. Both types offer advantages and disadvantages that should be considered.

| Company Type | Advantages | Disadvantages |

|---|---|---|

| Large National Companies (e.g., Geico, State Farm) | Wide network of agents and services; extensive brand recognition; often offer competitive rates and various discounts; convenient online tools and resources. | Potentially less personalized service; may lack local expertise; may not offer specialized programs for niche demographics. |

| Regional Providers | More personalized service; may offer specialized programs for local communities; potentially stronger community ties; may offer more competitive rates for specific demographics in their region. | Smaller network of agents and services; may have less brand recognition; potentially less technological advancement in online tools and resources. |

Understanding Policy Coverage

Navigating the world of auto insurance can feel like deciphering a secret code, especially when it comes to understanding the different types of coverage. Knowing what each type protects you from is crucial for securing the right policy and avoiding costly surprises down the road. Let’s break down the key components to help you make informed decisions.

Auto insurance policies typically bundle several types of coverage, each designed to protect you in specific situations. The combination of coverage you choose, along with your deductible and other factors, directly impacts your premium – the amount you pay for your insurance. Understanding these components empowers you to tailor your policy to your needs and budget.

Liability Coverage

Liability coverage protects you financially if you cause an accident that injures someone or damages their property. It covers the costs of medical bills, lost wages, and property repairs for the other party involved. For example, if you rear-end another car causing injury and property damage, your liability coverage would help pay for the other driver’s medical expenses and vehicle repairs. The amount of liability coverage you carry is typically expressed as a three-number limit, such as 25/50/25, representing $25,000 per person for bodily injury, $50,000 total for bodily injury per accident, and $25,000 for property damage. Higher limits offer greater protection but usually come with a higher premium.

Collision Coverage

Collision coverage pays for repairs to your vehicle if it’s damaged in an accident, regardless of who is at fault. This means even if you caused the accident, your collision coverage will help cover the cost of fixing your car. Imagine you hit a deer, or another car hits you while parked. Collision coverage would help cover the cost of repairs to your vehicle. This coverage typically has a deductible, which is the amount you pay out-of-pocket before your insurance kicks in.

Comprehensive Coverage

Comprehensive coverage protects your vehicle from damage caused by events other than collisions. This includes things like theft, vandalism, hail damage, fire, and even damage from hitting an animal. For instance, if a tree falls on your car during a storm, or someone keys your car in a parking lot, comprehensive coverage would help pay for the repairs. Like collision coverage, comprehensive coverage usually has a deductible.

Deductibles and Premiums

Your deductible is the amount you pay out-of-pocket before your insurance company starts paying for covered repairs. A higher deductible typically means a lower premium (the amount you pay for your insurance). Conversely, a lower deductible means a higher premium. The ideal balance between deductible and premium depends on your individual financial situation and risk tolerance. For example, someone with a larger emergency fund might opt for a higher deductible to lower their monthly premium.

Choosing the right deductible is a balancing act. A higher deductible lowers your premium but increases your out-of-pocket expenses in the event of a claim. A lower deductible means higher premiums but less out-of-pocket cost in case of an accident. Consider your financial situation and risk tolerance when making this decision.

Optional Add-ons

Many insurance companies offer optional add-ons to enhance your basic auto insurance policy. These can provide additional protection and peace of mind.

- Roadside Assistance: Covers towing, flat tire changes, jump starts, and lockout services.

- Rental Car Reimbursement: Helps pay for a rental car while your vehicle is being repaired after an accident or other covered event.

- Uninsured/Underinsured Motorist Coverage: Protects you if you’re involved in an accident with an uninsured or underinsured driver.

- Gap Insurance: Covers the difference between the actual cash value of your vehicle and the amount you owe on your loan if your car is totaled.

Minimizing Insurance Costs

Source: keymedia.com

Finding the cheapest car insurance is a smart move, but actively minimizing your costs is even smarter. It’s not just about finding a low initial quote; it’s about making choices that keep your premiums down year after year. This involves a combination of proactive steps and smart financial decisions. Let’s explore some key strategies.

Defensive Driving Courses

Taking a defensive driving course can significantly lower your insurance premiums. Many insurance companies offer discounts for completing these courses, recognizing that drivers who understand defensive driving techniques are statistically less likely to be involved in accidents. These courses typically cover safe driving practices, hazard recognition, and accident avoidance strategies. The discount amount varies depending on your insurer and the specific course you complete, but it can often represent a substantial saving over the cost of the course itself. For example, State Farm might offer a 10% discount, while Geico might offer a 5% discount, both depending on your driving record and location. It’s always worth checking with your provider to see what they offer.

Anti-theft Devices

Installing anti-theft devices in your vehicle is another effective way to reduce your insurance costs. Insurance companies view cars with anti-theft systems as less risky to insure, leading to lower premiums. These devices can range from simple steering wheel locks to sophisticated GPS tracking systems and alarm systems. The more comprehensive the system, the greater the potential discount. Imagine the savings: a high-quality alarm system might cost a few hundred dollars upfront, but the ongoing premium reduction could easily offset that cost over a few years. The specific discount will depend on the type of device and your insurer’s policies.

Credit Score Impact

Your credit score plays a surprisingly significant role in determining your car insurance rates. Insurers use credit-based insurance scores to assess your risk profile. A good credit score generally indicates responsible financial behavior, which insurers often correlate with responsible driving habits. Maintaining a good credit score (generally 700 or above) can result in substantial savings on your premiums. Conversely, a poor credit score can lead to significantly higher rates. This is because insurers perceive individuals with poor credit scores as higher risk, potentially leading to increased claim payouts. For example, someone with a 600 credit score might pay 20-30% more than someone with a 750 credit score, depending on the insurer and other factors.

Increasing Your Deductible

Raising your deductible – the amount you pay out-of-pocket before your insurance coverage kicks in – is a direct way to lower your premiums. A higher deductible means you’ll pay more in the event of an accident, but in exchange, your monthly premiums will be lower. It’s a trade-off: a higher deductible reduces your monthly payments, but increases your financial responsibility in the event of a claim. For example, increasing your deductible from $500 to $1000 could lead to a noticeable reduction in your premium, potentially saving you hundreds of dollars annually. Carefully weigh the potential savings against your ability to afford a larger out-of-pocket expense if you need to file a claim.

Bundling Home and Auto Insurance

Many insurance companies offer discounts for bundling your home and auto insurance policies. This is because insuring multiple policies with the same company simplifies their administrative processes and reduces their overall risk. Bundling can lead to significant savings compared to purchasing separate policies from different insurers. The exact discount varies widely depending on the insurer and the specifics of your policies, but it can often amount to 10-20% or even more on your overall premium. This is a simple way to consolidate your insurance needs and potentially save a considerable amount of money.

Illustrative Examples of Policy Scenarios

Source: dreamstime.com

Understanding different auto insurance policy scenarios helps you make informed decisions about coverage and cost. Let’s explore some examples to illustrate the trade-offs involved.

Higher Premium Justified by Comprehensive Coverage

Imagine Sarah, a young professional who just bought a brand new luxury SUV. She lives in a city with a high rate of theft and vandalism. Choosing a comprehensive policy with higher coverage limits for collision, comprehensive, and uninsured/underinsured motorist protection makes sense for her. While the premium is significantly higher than a basic liability-only policy, the peace of mind knowing her investment is fully protected outweighs the cost. In the event of an accident, theft, or vandalism, the comprehensive coverage would cover repair or replacement costs, potentially saving her tens of thousands of dollars. The higher premium is a worthwhile investment given the value of her vehicle and the risks she faces.

Lower Premium Leading to Inadequate Protection

Conversely, consider Mark, a college student driving an older, less valuable car. He opts for the cheapest liability-only policy available. While this significantly reduces his monthly premiums, the coverage is minimal. If Mark were to cause an accident resulting in significant injuries or property damage to another party, his liability coverage might not be sufficient to cover the claims. He could face substantial personal financial liability, potentially impacting his credit and future financial stability. His lower premium comes at the risk of catastrophic financial consequences if he is involved in a serious accident.

Hypothetical Policy Details

Let’s analyze a hypothetical policy for a mid-sized sedan driven by a 35-year-old with a clean driving record.

Policy A: Comprehensive Coverage

– Liability: $100,000/$300,000 Bodily Injury, $50,000 Property Damage

– Collision: $500 deductible

– Comprehensive: $500 deductible

– Uninsured/Underinsured Motorist: $100,000/$300,000

– Monthly Premium: $150

Policy B: Basic Liability Coverage

– Liability: $25,000/$50,000 Bodily Injury, $10,000 Property Damage

– Collision: None

– Comprehensive: None

– Uninsured/Underinsured Motorist: None

– Monthly Premium: $75

Policy Comparison

A simple text-based comparison table illustrates the key differences:

| Feature | Policy A (Comprehensive) | Policy B (Basic Liability) |

|—————–|————————–|—————————|

| Liability | $100,000/$300,000/$50,000 | $25,000/$50,000/$10,000 |

| Collision | $500 Deductible | None |

| Comprehensive | $500 Deductible | None |

| Uninsured/Underinsured | $100,000/$300,000 | None |

| Monthly Premium | $150 | $75 |

This clearly shows that while Policy A costs twice as much, it offers significantly broader protection. The choice depends on individual risk tolerance and financial circumstances.

Closing Summary

Finding cheap best auto insurance isn’t about sacrificing safety for savings. It’s about strategic planning and informed decision-making. By understanding the factors that affect your premiums, comparing quotes diligently, and knowing what coverage you truly need, you can secure affordable protection that provides peace of mind. Remember, a little research can go a long way towards keeping your wallet happy and your car insured.