Best workers comp insurance for construction isn’t just about ticking a box; it’s about safeguarding your crew and your business. Construction sites are inherently risky, with electricians battling high voltage, carpenters handling sharp tools, and laborers facing heavy lifting hazards. The right insurance isn’t just a cost; it’s a crucial investment protecting you from crippling financial losses after workplace accidents. This guide cuts through the jargon, helping you navigate the complexities of finding the best coverage for your specific needs.

We’ll delve into the specific risks faced by various construction trades, comparing policy types, evaluating insurers, and exploring cost-saving strategies. We’ll also cover crucial aspects like claims processes, regulatory compliance, and showcase successful case studies of construction companies who’ve mastered workers’ compensation. Get ready to build a safer, more financially secure future for your construction business.

Understanding Construction Worker Risks

Source: ctfassets.net

Construction work, while vital to our infrastructure, is inherently dangerous. The industry boasts a significantly higher rate of workplace injuries and fatalities compared to many other sectors. Understanding the specific risks faced by construction workers is crucial for implementing effective safety measures and securing appropriate workers’ compensation insurance. This knowledge allows for a more accurate assessment of potential claims and helps determine the necessary coverage to protect both employers and employees.

The most common workplace injuries in construction involve falls, struck-by incidents, caught-in/between hazards, and overexertion. These injuries often result in significant medical expenses, lost wages, and long-term disability, placing a substantial burden on both the injured worker and the employer. The severity and frequency of these injuries directly influence the cost of workers’ compensation insurance premiums. Higher incident rates lead to higher premiums, reflecting the increased risk assumed by the insurer.

Common Construction Injuries by Trade

Construction workers face diverse risks depending on their specific trade. Carpenters, for instance, frequently work at heights, increasing their risk of falls. Electricians handle high-voltage equipment, exposing them to electrical shocks and burns. Laborers, often involved in heavy lifting and material handling, are prone to back injuries and musculoskeletal disorders. These variations in risk profiles are reflected in the cost and design of workers’ compensation insurance policies. A policy for a company employing primarily electricians will likely be more expensive than one for a company with mainly laborers due to the higher potential for severe electrical injuries.

Risk Factors and Insurance Costs

Several factors contribute to the cost and coverage of workers’ compensation insurance for construction companies. The number of employees, the company’s safety record (as reflected in past claims), the type of work performed, and the location of the worksite all play a significant role. A company with a history of numerous and costly claims will pay significantly higher premiums than a company with a strong safety record and fewer incidents. Similarly, working at significant heights or with hazardous materials dramatically increases the risk profile, leading to higher insurance costs. For example, a high-rise construction project will require a more comprehensive and expensive policy than a smaller residential building project. Furthermore, geographic location can impact costs; states with higher average workers’ compensation claim costs will generally have higher premiums.

Key Features of Workers’ Compensation Policies

Navigating the world of workers’ compensation insurance for your construction business can feel like scaling a skyscraper without safety gear. Understanding the nuances of different policies and their features is crucial for protecting your business and your employees. This section will break down the key elements you need to know to choose the right coverage.

Choosing the right workers’ compensation policy hinges on several critical factors. The policy type, coverage limits, deductibles, and your experience modification rate (EMR) all play a significant role in determining your premiums and the level of protection afforded to your company. Let’s delve into these essential components.

Types of Workers’ Compensation Policies

Construction companies typically have access to several types of workers’ compensation policies, each tailored to specific business needs and risk profiles. A common approach is a standard policy offering a basic level of coverage, which may be sufficient for smaller businesses with a consistent, low-risk profile. Larger or higher-risk businesses might benefit from more comprehensive policies that include broader coverage or additional liability protections. Some policies might offer specialized coverage for specific types of construction work, such as demolition or high-rise building. The choice ultimately depends on a thorough risk assessment and consultation with an insurance professional.

Coverage Limits and Deductibles

Coverage limits define the maximum amount your workers’ compensation insurance will pay for covered claims. These limits can vary significantly depending on the policy type and the state’s regulations. For construction, where injuries can be severe and costly, it’s vital to ensure your coverage limits are adequate to cover potential medical expenses, lost wages, and rehabilitation costs for injured workers. A higher coverage limit offers greater financial protection, though it will usually come with a higher premium. Deductibles, on the other hand, represent the amount you pay out-of-pocket before your insurance coverage kicks in. A higher deductible will usually lower your premium, but it means shouldering more of the cost in the event of a claim. The optimal balance between coverage limits and deductibles needs careful consideration based on your company’s financial capacity and risk tolerance. For instance, a small contractor might choose a higher deductible to lower premiums, while a large firm with substantial resources might opt for lower deductibles and higher coverage limits.

Experience Modification Rate (EMR)

Your experience modification rate (EMR), often referred to as your “mod,” is a crucial factor influencing your workers’ compensation premiums. It’s a number that reflects your company’s past loss experience compared to the industry average. An EMR of 1.0 indicates your loss experience is average; an EMR below 1.0 suggests better-than-average safety performance and lower premiums, while an EMR above 1.0 suggests a higher-than-average loss experience and, consequently, higher premiums. Construction companies with strong safety programs and a history of fewer workplace accidents tend to have lower EMRs and, therefore, lower insurance costs. For example, a construction firm with a consistently strong safety record, resulting in an EMR of 0.8, might secure significantly lower premiums compared to a company with a poor safety record and an EMR of 1.3. Improving your safety record is a key strategy for reducing your EMR and lowering your insurance costs.

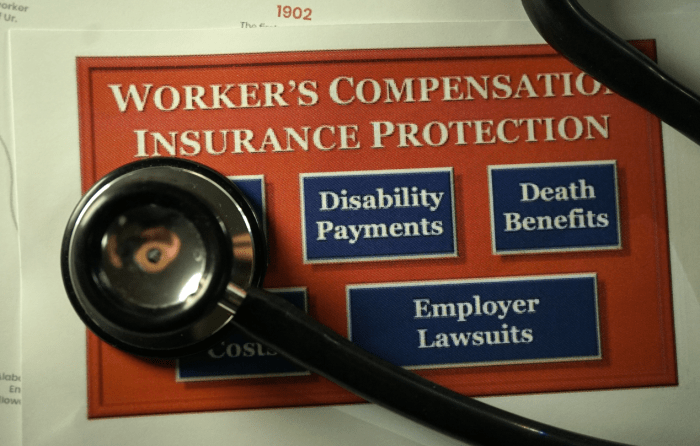

Additional Coverage Options: Employer’s Liability Insurance

While workers’ compensation insurance covers medical expenses and lost wages for injured employees, it doesn’t protect you from lawsuits filed by employees or their dependents. This is where employer’s liability insurance steps in. This supplementary coverage protects your business from claims alleging negligence or other employer-related liability, even if the employee’s injuries are covered under workers’ compensation. For instance, if an employee sues you for a workplace injury alleging your negligence contributed to the accident, employer’s liability insurance would help cover legal fees and potential settlements or judgments. This additional layer of protection is especially valuable for construction companies, where the risk of serious injuries and subsequent lawsuits is higher.

Choosing the Right Insurer: Best Workers Comp Insurance For Construction

Source: insureguardian.com

Picking the right workers’ compensation insurance provider for your construction business is crucial. The wrong choice can lead to inadequate coverage, higher premiums, and headaches when you need them most. A thorough evaluation process, considering factors beyond just price, is key to securing the best protection for your company and your employees.

Choosing the right workers’ compensation insurer involves careful consideration of several key factors. It’s not simply a matter of finding the cheapest option; long-term value and reliable service are paramount. Understanding your specific needs and comparing providers based on a set of criteria will lead to a more informed decision.

Criteria for Evaluating Workers’ Compensation Providers

Several key criteria should guide your evaluation of different workers’ compensation insurance providers. These factors contribute to a comprehensive assessment of each insurer’s suitability for your construction business. Consider financial stability, claims handling process, customer service responsiveness, and the availability of risk management resources. A strong safety record and proactive risk management can significantly reduce premiums in the long run.

Benefits of Using a Construction Insurance Broker

Navigating the complex world of workers’ compensation insurance can be daunting. A specialized construction insurance broker acts as your advocate, offering invaluable expertise and assistance. They have access to a wider range of insurers, allowing them to negotiate better rates and find policies that precisely match your business’s needs. They can handle all the paperwork and ensure you have the right coverage, saving you time and effort. Brokers also provide ongoing support, helping you manage your policy and navigate any claims. Essentially, they act as a crucial intermediary, ensuring you receive the best possible service and protection.

Comparison: National vs. Regional Insurers

Large national insurers often offer broad coverage and established processes, but may lack the personalized service of smaller regional providers. Regional insurers, on the other hand, might offer more localized expertise and a more personal touch, but their financial resources might be less extensive than their national counterparts. The choice depends on your business size, risk profile, and specific needs. For instance, a large national firm might be better suited for a large-scale construction project, while a smaller regional insurer might be a better fit for a smaller, localized business.

Advantages and Disadvantages of Different Insurer Types

| Insurer Type | Advantages | Disadvantages | Best Suited For |

|---|---|---|---|

| Large National Insurer | Broad coverage, established processes, financial stability, extensive resources | Potentially higher premiums, less personalized service, less local expertise | Large construction firms, complex projects, nationwide operations |

| Smaller Regional Insurer | Personalized service, local expertise, potentially lower premiums, quicker claims processing | Limited resources compared to national insurers, potentially less financial stability | Smaller construction firms, localized projects, businesses valuing personal relationships |

| Mutual Insurance Company | Potentially lower premiums due to policyholder ownership, focus on risk prevention | Less flexibility in policy options, may require greater participation in safety programs | Businesses prioritizing long-term cost savings and risk management |

| Specialty Construction Insurer | Deep understanding of construction industry risks, tailored coverage options, proactive risk management services | May have higher premiums due to specialized expertise, limited geographic reach | Businesses with unique or high-risk construction projects |

Cost Factors and Savings Strategies

Source: buyliability.com

Understanding the cost of workers’ compensation insurance for construction companies is crucial for effective budgeting and long-term financial health. Numerous factors influence premiums, and proactive strategies can significantly reduce expenses. This section delves into these factors and explores effective cost-saving measures, emphasizing the importance of a robust safety program.

Several key factors significantly impact the cost of workers’ compensation insurance for construction firms. The most prominent is the company’s claims history. A history of frequent or high-cost claims will inevitably lead to higher premiums. The type of construction work undertaken also plays a significant role; high-risk projects like demolition or high-rise construction naturally attract higher premiums due to the inherent dangers. Payroll is another major factor; higher payroll equates to higher premiums, as premiums are typically calculated as a percentage of payroll. Finally, the state in which the company operates influences costs due to variations in state regulations and insurance market dynamics. For instance, states with higher rates of workplace accidents generally have higher workers’ compensation insurance premiums.

Safety Programs and Premium Reduction

Implementing comprehensive safety programs and providing thorough employee training are the most effective ways to lower workers’ compensation insurance premiums. Insurance carriers recognize the value of proactive safety measures and often reward companies with strong safety records through reduced premiums or safety bonuses. A well-designed safety program demonstrates a commitment to employee well-being and risk mitigation, leading to fewer accidents and lower claims costs. This positive feedback loop results in lower premiums over time, offering significant long-term cost savings. For example, a construction company with a robust safety program resulting in a 20% reduction in workplace accidents might see a comparable reduction in their workers’ compensation premiums.

Sample Safety Program for a Construction Company

A successful safety program needs to be comprehensive, covering all aspects of construction work. This sample program Artikels key components:

1. Pre-Job Safety Planning: Before any project begins, a detailed safety plan should be developed and reviewed by all involved personnel. This plan should identify potential hazards, Artikel safety procedures, and specify the use of personal protective equipment (PPE).

2. Regular Safety Training: Employees should receive regular training on safety regulations, hazard recognition, and the proper use of equipment and PPE. This training should be tailored to the specific tasks they perform and should include hands-on demonstrations and practical exercises.

3. PPE Provision and Enforcement: The company should provide appropriate PPE, such as hard hats, safety glasses, and safety harnesses, and enforce their consistent use on the job site. Regular inspections should ensure that PPE is in good condition and properly fitted.

4. Incident Reporting and Investigation: A clear procedure for reporting and investigating workplace accidents should be established. Thorough investigations help identify root causes of accidents and inform future preventative measures.

5. Regular Safety Inspections: Regular inspections of the worksite should be conducted to identify and rectify potential hazards before they lead to accidents. These inspections should be documented and followed up with corrective actions.

6. Emergency Response Plan: A comprehensive emergency response plan should be in place, including procedures for handling various emergencies, such as fires, medical emergencies, and hazardous material spills.

7. Employee Participation and Feedback: Encouraging employee participation in safety programs and providing opportunities for feedback are crucial for building a strong safety culture. Regular safety meetings can provide a platform for open communication and problem-solving.

Ways to Reduce Workers’ Compensation Costs

| Strategy | Description | Example | Potential Savings |

|---|---|---|---|

| Improved Safety Training | Invest in comprehensive safety training programs for all employees. | Implement a new training program focusing on fall protection techniques. | Reduced frequency and severity of fall-related injuries. |

| Regular Safety Audits | Conduct regular safety audits to identify and address potential hazards. | Monthly inspections of scaffolding and equipment. | Early detection and mitigation of hazards, preventing accidents. |

| Employee Incentive Programs | Reward employees for safe work practices and reporting near misses. | Offer bonuses or gift cards for maintaining a perfect safety record. | Improved safety culture and reduced accident rates. |

| Ergonomic Improvements | Implement ergonomic improvements to reduce the risk of musculoskeletal injuries. | Provide ergonomic tools and adjust workstations to minimize strain. | Reduced incidence of back injuries and other musculoskeletal disorders. |

Claims Process and Dispute Resolution

Navigating the workers’ compensation claims process after a construction accident can feel like scaling a skyscraper without safety gear. Understanding the steps involved and your rights is crucial to ensuring a fair and timely resolution. This section breaks down the process, common disputes, and methods for resolving them.

Filing a workers’ compensation claim typically begins with immediate reporting of the injury to your supervisor. This initial notification triggers a series of actions by both you and your insurer. Accurate and detailed documentation is key throughout the entire process.

Steps in Filing a Workers’ Compensation Claim, Best workers comp insurance for construction

The claim process usually involves several distinct steps. Prompt action and thorough documentation are essential at each stage to avoid delays or complications.

- Immediate Reporting: Report the injury to your supervisor immediately, regardless of its apparent severity. This is often the first crucial step in initiating the claims process.

- Medical Treatment: Seek medical attention from a physician approved by your insurer. This ensures that your treatment is covered under the policy and properly documented.

- Filing the Claim Form: Complete and submit the necessary claim forms provided by your insurer. Accuracy in providing details about the incident and injuries is paramount.

- Insurer Review and Investigation: The insurer will review your claim, investigate the incident, and may request additional information or documentation.

- Benefits Determination: Based on the investigation, the insurer will determine the benefits you are entitled to, such as medical expenses and lost wages.

- Ongoing Communication: Maintain open communication with your insurer and your healthcare provider throughout the process. Regular updates on your progress and any changes in your condition are vital.

The Insurer’s Role in Claim Management and Resolution

The insurer plays a central role in managing and resolving workers’ compensation claims. Their responsibilities extend beyond simple benefit payments.

Insurers are responsible for investigating the claim, verifying the legitimacy of the injury and its connection to the workplace, and determining the appropriate benefits. They also manage the medical care process, ensuring that treatment aligns with the worker’s needs and the policy’s provisions. This often includes coordinating with healthcare providers and reviewing medical bills for accuracy and necessity. In cases of disputes, the insurer facilitates communication and may propose resolution methods.

Common Disputes in Workers’ Compensation Claims

Disputes in workers’ compensation cases frequently arise from disagreements about the cause of the injury, the extent of the disability, or the adequacy of the benefits provided.

- Causation: Disputes may arise if the insurer questions whether the injury occurred at work or was caused by pre-existing conditions.

- Extent of Disability: Disagreements can occur regarding the severity of the injury and its impact on the worker’s ability to perform their job. This often involves differing opinions from medical professionals.

- Benefit Adequacy: Workers may dispute the amount of compensation offered, particularly if it’s insufficient to cover medical expenses or lost wages.

- Return-to-Work Issues: Disputes can arise regarding the appropriateness of a proposed return-to-work plan, including the suitability of modified duties or the timing of the return.

Dispute Resolution Methods

Several methods exist for resolving disputes in workers’ compensation cases, aiming for a fair and efficient resolution without resorting to lengthy and costly litigation.

Mediation: A neutral third party helps both sides communicate and negotiate a settlement. Mediation is often a less formal and less adversarial approach than arbitration or litigation. A successful mediation results in a mutually agreeable settlement.

Arbitration: A neutral arbitrator hears evidence and arguments from both sides and renders a binding decision. Arbitration is more formal than mediation and is generally binding, meaning both parties must abide by the arbitrator’s decision.

Litigation: If mediation and arbitration fail, the case may proceed to court. This is generally a last resort, as litigation can be time-consuming and expensive.

Finding the best workers comp insurance for construction can be a real headache, but it’s crucial for protecting your crew. Consider your options carefully, and don’t overlook reputable providers like maryville insurance , who might offer competitive rates and solid coverage tailored to the construction industry. Ultimately, securing the right workers’ comp policy is about safeguarding your business and your people.

Regulatory Compliance

Navigating the complex world of workers’ compensation insurance for construction requires a firm understanding of federal and state regulations. Failure to comply can lead to significant financial penalties and reputational damage, impacting your business’s bottom line and sustainability. This section Artikels key regulations, penalties for non-compliance, and strategies for ensuring you remain compliant.

Federal and state regulations governing workers’ compensation insurance for the construction industry are multifaceted and vary significantly. Understanding these differences is crucial for effective risk management. Non-compliance can result in substantial fines, legal battles, and even business closure. Proactive compliance is essential for long-term success.

Key Federal and State Regulations

The Occupational Safety and Health Administration (OSHA) plays a significant role at the federal level, setting standards for workplace safety that indirectly impact workers’ compensation. States, however, largely manage their own workers’ compensation insurance programs, resulting in a patchwork of regulations across the country. For example, some states mandate specific types of coverage, while others have different requirements for reporting workplace injuries. Specific regulations vary widely, so it is imperative to consult the relevant state’s Department of Labor or equivalent agency for accurate and up-to-date information. Understanding your state’s specific requirements is paramount.

Penalties for Non-Compliance

Penalties for non-compliance with workers’ compensation regulations can be severe and vary by state. These can include significant fines, back payments for unpaid premiums, interest charges, and even criminal prosecution in some cases. For instance, a contractor in California who fails to secure workers’ compensation insurance could face fines ranging from thousands to tens of thousands of dollars, depending on the severity and duration of the violation. In addition to financial penalties, non-compliance can lead to loss of bonding privileges, difficulty obtaining contracts, and damage to the company’s reputation.

Ensuring Compliance with Reporting Requirements

Prompt and accurate reporting of workplace injuries and illnesses is critical for maintaining compliance. Most states require employers to report injuries within a specific timeframe, often 24 to 72 hours. This reporting typically involves filing forms with the relevant state agency, providing details about the incident, the injured worker, and the nature of the injury. Failure to report promptly and accurately can result in penalties. Maintaining detailed records of all incidents, including incident reports, medical records, and investigation findings, is essential for supporting your reporting and demonstrating your commitment to safety. Regularly reviewing your company’s safety procedures and employee training programs can also help prevent accidents and ensure accurate reporting.

Resources for Staying Up-to-Date

Staying informed about changes in workers’ compensation laws is an ongoing process. Several resources can assist in this endeavor. State Department of Labor websites provide the most up-to-date information on state-specific regulations. Professional organizations, such as the Associated General Contractors of America (AGC), offer resources, training, and advocacy related to workers’ compensation. Legal counsel specializing in workers’ compensation can also provide valuable guidance and support in navigating the complexities of the system. Regularly reviewing these resources ensures your company remains compliant and adequately protected.

Case Studies

Understanding how other construction companies have successfully managed workers’ compensation costs provides invaluable insights. Learning from their best practices can help your own company develop and implement effective strategies to minimize risks and control expenses. The following case studies illustrate diverse approaches to safety and claims management, highlighting the positive outcomes achieved.

Successful Workers’ Compensation Management Strategies in Construction

The success of a robust workers’ compensation program hinges on proactive safety measures, efficient claims handling, and a commitment to employee well-being. Companies that prioritize these areas consistently achieve lower costs and improved employee morale. Below, we analyze specific examples.

| Company | Strategies Implemented | Results Achieved | Key Takeaways |

|---|---|---|---|

| Acme Construction | Implemented a comprehensive safety training program including regular toolbox talks, job-site safety inspections, and the use of personal protective equipment (PPE). They also invested in ergonomic assessments to modify workstations and reduce repetitive strain injuries. Furthermore, they established a strong safety culture through employee involvement and incentives. | Experienced a 30% reduction in workplace injuries over three years, resulting in a 20% decrease in workers’ compensation premiums. Employee satisfaction scores also increased significantly. | Proactive safety training and a strong safety culture are paramount. Investing in ergonomic improvements yields significant returns. |

| Best Built Homes | Focused on early intervention in claims management. They established a rapid response team to investigate incidents promptly, provide immediate medical attention, and initiate the claims process efficiently. They also partnered with a specialized workers’ compensation claims management firm to ensure claims were handled effectively and legally compliant. | Reduced average claim costs by 15% and shortened the average claim resolution time by 25%. This streamlined process minimized disruption to operations and improved employee relations. | Swift and efficient claims management is crucial to minimize costs and disruption. Partnering with specialized firms can enhance expertise. |

| Superior Structures Inc. | Developed a robust return-to-work program. This program included early intervention by occupational health professionals, modified duty assignments, and ongoing support to help injured workers regain their full capabilities. They also emphasized open communication and collaboration with employees throughout the recovery process. | Significantly reduced lost-time injuries and improved employee retention rates. The program also fostered a positive work environment and enhanced employee loyalty. | A comprehensive return-to-work program minimizes lost productivity and fosters employee loyalty. Open communication is key. |

| Quality Concrete Co. | Implemented a sophisticated safety management system (SMS) incorporating regular audits, risk assessments, and leading indicators to identify and mitigate potential hazards before incidents occur. They used data analytics to pinpoint high-risk areas and implement targeted interventions. | Achieved a 40% reduction in recordable incidents and a corresponding 25% decrease in workers’ compensation costs. The data-driven approach allowed for continuous improvement in safety performance. | Data-driven safety management systems offer valuable insights for proactive risk mitigation and cost reduction. |

Summary

Securing the best workers’ compensation insurance for your construction company is a multifaceted process demanding careful consideration of risks, policy features, and insurer capabilities. By understanding the nuances of coverage, leveraging safety programs, and choosing a reliable provider, you can significantly mitigate financial risks and build a strong foundation for a successful and safe operation. Remember, proactive safety measures and informed insurance choices are not just expenses; they’re investments in the well-being of your workforce and the long-term health of your business. Don’t leave your future to chance – equip yourself with the knowledge to make the right decisions.